CHAPTER 1: INTRODUCTION

1.1) Research Purpose

Macroeconomics and international finance research have devotedsubstantial attention on impossible trinity theory and how a country canpursue a strategic policy toolkit to confront this trilemma, particularly in thewake of tsunami of Asian crisis in 1997 and global financial crisis in 2008. Alarge corpus of literature demonstrate methods of measuring the impossibletrinity (Chinn and Ito, 2008; Aizenman, et al. 2010; and Ito and Kawai, 2014)and the index of the trilemma policy convergence (Aizenman and Ito, 2011)with most of the datasets are industrial countries. There are some researchalso raise this challenge as well as recommend fit international monetarysystems to developing countries (Patnaik and Shah, 2010; Jian, et al. 2011;Carton, 2011; and Sun and Payette, 2016) in order to help protect them fromtremendous turbulences in the context of financial integration and currencyinternationalization. Other studies shed lights into the linkage betweentrilemma and currency internationalization (Sun and Payette, 2016 andAnderson, 2016) in corresponding to Special Drawing Rights (SDR) basketwith the pattern is China.

Although there are growing academic papers attempt to study impossibletrinity in emerging markets using China as a representative model(Aizenman, et al. 2011; Jian, et al. 2011; Sun and Payette, 2016; Sun and Li,2017) and yield fresh insights regarding the Chinese RMB’s inclusion inSDR basket (Qiao and Ge, 2015; Sun and Wu, 2016; Suzuki, 2016; Harrisonand Xiao, 2018), little empirical evidence reveals the direct associationbetween the watershed event that the Chinese renminbi was included into theSDR and the Chinese triad policy. Since the first review in 2010 byInternational Monetary Fund (IMF), China has gained exceptional growth inits economy which fuels RMB to become more widely and freely used to beformally a SDR basket’s component in 5 years later.

......................

1.2) Research Subject

This paper uses China as a research destination for three followingreasons. Firstly, China experiences the phenomenal growth as transformsfrom a stable agrarian society making late economic reforms in 1978, it isnow one of the economic behemoths by boasting its “One Belt and One RoadInitiative” and “antagonizing” the strongest empire that is U.S via the TradeWar in 2018 with its ambition of becoming an influential nation over theworld in the coming time.

Furthermore, as a self-insure against financial instability and mechanismof its current international monetary system to handle the impossible trinity,despite of announcing to employ a managing float exchange rate regime withreference to a basket of currencies (Frankel and Wei, 2007), China puts aheavy weight on U.S. dollar and is the largest hoarder of dollar reserves(Aizenman and Ito, 2011). Therefore, China is actually not only a centralemerging market economy but also with its currency is a SDR componentcurrency, its development will exert extant significant impacts on theinternational marketplace, therefore; mismanaging trilemma in China can“send shockwaves throughout the global economy” (Sun and Payette, 2016).

...........................

CHAPTER 2: THEORETICAL BACKGROUND

2.1) Impossible Trinity

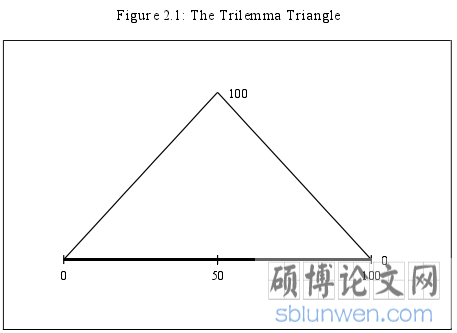

The classical impossible trinity or trilemma theory is firstly introducedby Mundell, 1963, which posits that a country cannot simultaneously obtainan unfettered capital flow, an autonomous monetary policy, and a fixedexchange rate regime. The impossible trinity is commonly illustrated by atrilemma triangle as plotted in Figure 1, in which there are three verticesmeasure three indexes of impossible trinity theory including Monetary PolicyIndependence, Exchange Rate Stability, and Financial Market Openness (Itoand Kawai, 2014).

Figure 2.1: The Trilemma Triangle

2.2) Special Drawing Rights (SDR)

According to the International Monetary Fund (IMF), SDR was createdby IMF in 1969 as an international reserve asset for the purpose of providingliquidity as well as augmenting its members’ official reserves. Before theaddition of the Chinese renminbi in December, 2015 (take effective sinceOctober 1st, 2016), the SDR basket consists of four major currenciesincluding the U.S. dollar, the euro, the Japanese yen, and the British poundsterling. Nowadays, together with the accession of the Chinese renminbi, theSDR’s value is pegged on the basket of the five currencies. It is noteworthythat the SDR can be exchanged for the currencies of IMF’s members andconsidered as IMF’s unit of account. The weight as well as fixed exchangerates of SDR’s member currencies against the SDR is reported in the Table2.1.

The IMF also constructs SDR interest rate (SDRi) in order to computethe paid and charged interests for related parties. The SDRi is determinedwith a floor of 5 basis points on the weekly basis relied on a weightedaverage of representative interest rates on short-term government debtinstruments in the money markets of the SDR components. The Table 2provides information on SDRi in the period from 2002 to 2019.

...........................

CHAPTER 3: LITERATURE REVIEW .................................. 14

3.1) Impossible Trinity ............................... 14

3.2) Adding RMB into SDR basket................................... 18

CHAPTER 4: METHODOLOGY AND SAMPLE OVERVIEW......................... 20

4.1) Methodology .......................... 20

4.1.1) Measuring Exchange Rate Stability (ERS) ....................... 20

4.1.2) Measuring Monetary Policy Independence (MPI) ....................... 23

CHAPTER 5: EMPIRICAL RESULTS....................... 30

CHAPTER 6: ADDITIONAL ANALYSIS

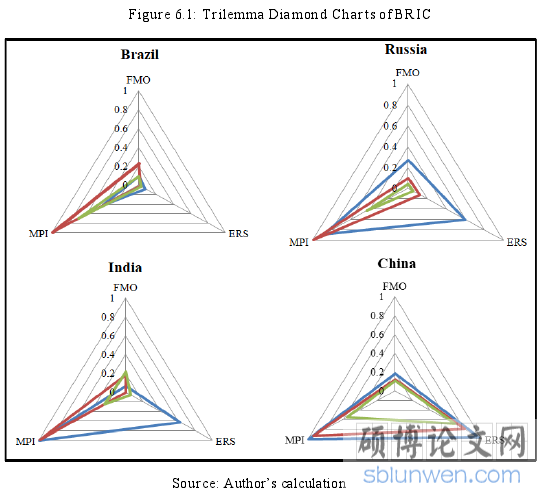

The study also extends the research object to other countries of the BRICblock including Brazil, Russia, and India (BRI). The BRIC term is initiallycreated by O'Neill, 2001 to stand for four countries that are Brazil, Russia,India, and China. Since then, a wave of literature concerning the BRICcountries has erupted, in particular their international economic developmentbecause they are highly associated with the global economy (Chen andLombaerde, 2014) and considered as the main force driving for future growthmarkets (Ulrich, et al. 2014). Among BRIC countries, China is suggested tobe in its own league (Ulrich, et al. 2014) because it witnesses a larger part ofindustrialization as compared to the other BRIC economies (Jacobs andRossem, 2014) and to dominate the BRIC’s evolution in terms of grossdomestic output (Belke, et al. 2019). Hence, the BRIC is essentially takeninto account of this research for the purpose of examining whether the entryof Chinese currency into the SDR basket as well as China’s internationalfinance practice cast effect on impossible trinity management of these threeeconomies.

Figure 6.1: Trilemma Diamond Charts of BRIC

CHAPTER 7: CONCLUSIONS AND POLICY RECOMMENDATION

7.1 Conclusions

The existence of the impossible trinity has long drawn attention of notonly the industrial economies but also the emerging markets such as China,in particularly in the stage of international integration and globalization. Withthe Chinese renminbi was adopted as a member of the SDR in 2016, whetherthis country faces the trilemma is still an open questions to either itsmacroeconomic authorities or the academia. Hence, this paper sheds aninsight into the effect of this accession on its impossible trinity management.Applying the trinity measurements of Ito and Kawai, 2014 to the Chinesesetting, this study estimates three metrics of the “holy trinity” including theexchange rate flexibility, monetary policy autonomy, and capital mobility forthe whole period between 2002 and 2019. This research takes the watershedevents that the Chinese currency’s de-pegging from U.S. dollar in 2005 andinclusion in the SDR in 2016 into consideration by making them as thebreaking points in the entire sample, in which the latter is the matter ofresearch interest. Specifically, the whole sample is divided into three sun-periods including (i) from 1st quarter 2002 to 3rd quarter 2005; (ii) from 4thquarter 2005 to 3rd quarter 2016; (iii) from 4th quarter 2016 to 3rd quarter2019.

reference(omitted)