CHAPTER 1: INTRODUCTION

1.1 Research Motivation

The main objective of this research paper is to determine the role of monetarypolicy variables in explaining exchange rate movements in The Gambia. The specificobjectives are to determine if the UIP theory holds for the case of The Gambia, ifexchange rate overshoots immediately in response to monetary policy shocks in TheGambia, and how much of variations in exchange rate movements is explained bymonetary shock.

Fluctuations in exchange rate affects all economic units. This has a bearing onthe businesses and households involved in international trade. Also, high volatility inthe foreign exchange market can have substantial impacts on a countries volume oftrade. In addition, governments, specifically in developing countries, are in a quest forways to handle the uncertainties often surrounding this volatility as these countries arethe alternate direction for foreign direct investments. This has been translated intogrowth in global financial transfers and hence, exchange rate volatility (Antonakakisand Darby, 2013). The improbability in determining the price of one currency inrelation to another makes it hard to explain movements in exchange rates. As such, thetopic has been at the center of scholarly debates for decades. Despite the fact that manymodels of exchange rate determination and their modifications have been established,researchers are still unable to agree on which model best describes exchange ratebehaviors. The empirical evidence to date on this subject has been somewhat mixed,sometimes even conflicting and puzzled many researchers which caused further theoretical growth in the developed world. At that, existing models have been testedmainly for developed countries while very few studies were conducted for developingcountries especially Sub Saharan African countries.

.......................

1.1 Research Motivation

The main objective of this research paper is to determine the role of monetarypolicy variables in explaining exchange rate movements in The Gambia. The specificobjectives are to determine if the UIP theory holds for the case of The Gambia, ifexchange rate overshoots immediately in response to monetary policy shocks in TheGambia, and how much of variations in exchange rate movements is explained bymonetary shock.

Fluctuations in exchange rate affects all economic units. This has a bearing onthe businesses and households involved in international trade. Also, high volatility inthe foreign exchange market can have substantial impacts on a countries volume oftrade. In addition, governments, specifically in developing countries, are in a quest forways to handle the uncertainties often surrounding this volatility as these countries arethe alternate direction for foreign direct investments. This has been translated intogrowth in global financial transfers and hence, exchange rate volatility (Antonakakisand Darby, 2013). The improbability in determining the price of one currency inrelation to another makes it hard to explain movements in exchange rates. As such, thetopic has been at the center of scholarly debates for decades. Despite the fact that manymodels of exchange rate determination and their modifications have been established,researchers are still unable to agree on which model best describes exchange ratebehaviors. The empirical evidence to date on this subject has been somewhat mixed,sometimes even conflicting and puzzled many researchers which caused further theoretical growth in the developed world. At that, existing models have been testedmainly for developed countries while very few studies were conducted for developingcountries especially Sub Saharan African countries.

.......................

1.2 Research Questions

This paper sets to test how pertinent the monetary model is in explaining theexchange rate movements between The Gambian Dalasi and the US Dollar, Euro andBritish Pound Sterling. Although economic units rely on the central bank to effectivelystabilize prices, and manage the fluctuations in the foreign exchange market. Assessinghow policy shocks impact exchange rate movements will be beneficial to commercialbanks and microfinance institutions returns as they heavily rely on exchange ratemovements. Understanding these movements could help lock in expected futureearnings related to foreign currency. This will help in creating value, which is animportant aspect of finance.

As per the research objectives, we hope to answer the following researchquestions. First, does the UIP theory hold for the case of The Gambia? Second, what isthe timing of exchange rate peak after a one time shock in non-borrowed reserves?Thirdly, what proportion of exchange rate movement is explained by monetary shock?

In this study we hypothesize the following. First, a deviation of the UIP for thecase of The Gambia. Secondly exchange rates to peak within the first few quarters aftera policy shock. And finally significant share of exchange rate movements is explainedby the model.

...........................

CHAPTER 2: RELEVANT THEORY AND LITERATUREREVIEW

2.1 The Purchasing Power Parity

The theory of Purchasing Power Parity (PPP) is an extension of the Law of OnePrice and is used to compare prices between any two countries. PPP as a concept ofexchange rate determination was developed by Cassel (1918), whose work was basedon parity adjustments for the nations that exited the gold standard in 1914 since theyexperienced considerably dissimilar inflation rates during and after the First WorldWar. This is the origin of PPP as a background of exchange rate determination. ThePPP expects that exchange rates would adjust to recompense for the differences in thelevel of prices of countries baskets of goods and services among any two nations. As aresult, the real exchange rate is constant, but the nominal exchange rate is a reflectionthe fraction of domestic prices to the foreign price of a particular basket of goods andservices (Lafrance and Schembri, 2002).

Monetary neutrality is the basic idea behind the doctrine of PPP. Price levelsare volatile, but in the long run, real variables are not expected to be dependent onchanges in the general price level. Empirically, the real exchange rate is non constantin the short run but has a constant long-run equilibrium value, which is similar to itsPPP value (Abauf and Jorion, 1990). PPP relies on the assumptions that; there exist notransportation cost, no trade restrictions, and perfect competition and hence noarbitrage opportunity. The results shown by Abauf and Jorion (1990); Flood and Taylor(1995); Hoarau (2010), indicates that PPP holds in the long run but not in the short run.

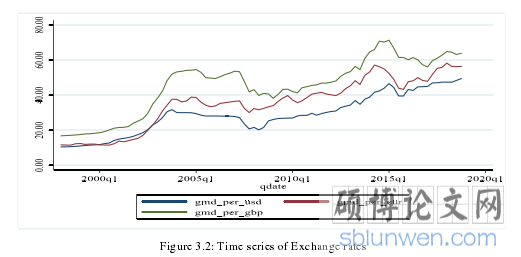

Figure 3.2: Time series of Exchange rates

2.2 Interest Rate Parity (IRP)

The theory of Interest rate parity (IRP) is also referred to as the Asset Approachto Exchange Rate Determination. The basic notion is that countries with higher interestrate would experience capital influx from foreign investors and hence the currency would be expected to appreciate (Bekaert et al., 2007), as a result, returns oninvestments should be identical across countries irrespective of the differences in theirinterest rates. The idea behind the (IRP) theory is that there is no risk on the returns ofinvestments. There is however no such thing as a risk-free investment, but theassumption is based on the fact that, when a country’s economic and financial systemis steady, then there is little or no default risk and hence the returns on treasury bondsare assured.

2.2.1 Uncovered Interest Rate Parity (UIP)

The uncovered interest rate parity theory is one of the interest rate parities inaddition to the covered interest rate. UIP is a non-arbitrage condition and the theorystates that, the difference between two countries interest rates equals the relative changein the exchange rates over the same period. When UIP is maintained, there is no surplusrevenue generated by higher returns on an alternative currency or interest rate spreadat the same time.

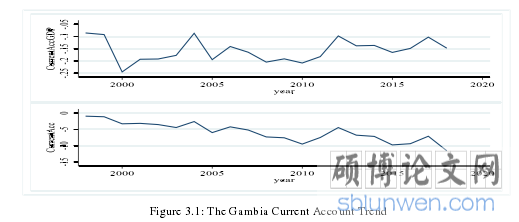

Figure 3.1: The Gambia Current Account Trend

CHAPTER 3: BACKGROUND OF THE GAMBIAN ECONOMY ........................ 17

3.1 The Openness of The Gambian Economy ............................ 1

3.2 Monetary Policy Instruments and Reserve Requirements.................... 18

CHAPTER 4: DATA AND METHODOLOGY ...................... 23

4.1 Variables .......................... 23

4.2 Data Processing and Analysis.............................. 23

CHAPTER 5: RESULTS AND DISCUSSION ............................ 27

5.1 Testing UIP.......................... 27

5.2 VAR.......................... 28

CHAPTER 5: RESULTS AND DISCUSSION

5.1 Testing UIP

Under the UIP hypothesis, if the return on a domestic interest returns are 1%lower than that on a foreign interest returns, then the domestic currency will beexpected to appreciate by 1% in the coming period. To achieve this, the constant termof the regression will be statistically equal to zero and the interest rate differentialcoefficient β will be statistically equal to one.

In practice, the theory is often severely violated and the most puzzling of all, isthat the estimate for β is often negative. A regression was done on et-1- et= +β (it -it*) +utto test this hypothesis for the three currency pairs. The test for stationarity andcollinearity are in Appendix B.

The results in Table 5.1 indicate that none of the intercept estimates for aresignificantly different from zero. However, unlike most findings in the literature, the βestimate over the period are positive for all three regressions. For the currency pairsGMD-USD, GMD-EUR and GMD-GBP, the slope estimates of β are 0.004, 0.003 and0.003 respectively. The test statistic for the null hypothesis β=1 [t= (β-1)/se] for GMD-USD, GMD-EUR and GMD-GBP result to |t|= 249, 199.4 and 294.25 respectively andP-value=0.000 for all. Therefore, we reject the null hypothesis of β=1 and hence,conclude that the UIP theory does not hold for all three currency pairs, thus a UIPdeviation.

.......................

CHAPTER 6: CONCLUSION

6.1 Theoretical contribution

Firstly, unlike most findings in literature, the UIP results showed positive βparameters similar to that of Chinn and Meredith (2004). Although we still rejected theUIP as expected, indicating that interest rate differential is a poor predictor of exchangerate gains, this paper successfully addressed the UIP premium anomaly puzzle.Secondly, through the introduction of structural shocks we find that exchange rateovershooting for the case of The Gambia appears to be immediate for the USD andGBP currency pairs as opposed to the Dornbusch overshooting. Finally, fundamentalsin the monetary model as a tool is not as crucial as stated by earlier studies in explainingexchange rate movements. The theoretical results present one answer to why theempirical relevance of existing classes of exchange rate theories is so poor (see, e.g.,Meese and Rogoff (1983) which shows the poor out-of-sample forecastingperformance). If a variable follows a certain path, it would be extremely sensitive tothe initial value and its forecast would be very difficult by usual statistical proceduresas stated by Cesa et al 2019. We therefore suppose that the endogeneity of exchangerate may have significant implications for the international transmission of shocks, foroptimal monetary policy, and for the gains from international coordination of monetarypolicies.

reference(omitted)