CHAPTER 1 Introduction

1.1 Research Background and Motivation

China is a unique example with remarkable changes since the introduction ofthe "Opening-up and Reform" policy in 1978. For almost 40 years, Chinese marketsare opened to international investments and obtained outstanding results in pullingforeign direct investment (FDI). From almost $0 in 1978, China reached ~$135 billionof FDI in 2018 with 539,345 foreign enterprises registered in China in 2017 (NationalBureau of Statistics of China). Different firms from all over the world, either solely-owned or as joint ventures with Chinese firms, have built a widespread presence inChina. Also, the Chinese “One Belt and One Road Initiative” (OBOR), is adevelopment strategy proposed by the Chinese Government. As a part of the “New SilkRoad initiative” it focuses on connectivity (like roads, ports, railways and other links)and cooperation between Asia, Europe, and Indo-Pacific countries.

Moreover, not only through national statistics but from daily life Chinese peoplecould with ease experience the changes with such companies as MacDonald’s, KFC,Coca-Cola, Apple, Zara, H&M, Disneyland, Walmart, Carrefour and a countlessnumber of other companies. From what it could be concluded that Chinese people’straditional lifestyle has changed with an increasing amount of FDI inflows. Suchmultinational enterprises’ (MNE’s) are playinga crucial part in promoting and formingthe possible pattern of economic development (Dunning, 2003), and all their choicesusually depend on their FDI decisions.

...................................

1.2 Research Aims and Objectives

This thesis aims to empirically investigate the determinants of FDI distributionin China and assess the effect of FDI on Chinese local investment. This aim will bereached by the following objectives.

1. To identify regional features of China's investment climate (study of thecurrent state of China's investment climate, highlight the main stages of investmentpolicy development, study the legal basis of China's investment policy, study the roleof Chinese "Huaqiao" as foreign investors in China, characterise China's regions in thecontext of their attractiveness to foreign investors based on regional differences andfeatures of Chinese provinces);

2. To investigate what particular factors significantly affect FDI locationchoice decisions in China using regional-level data from 1990 to 2018;

3. To examine the factors that determine FDI sector investment choice in theChinese market using sectoral data from 1991 to 2018. All the sectors were dividedinto primary, secondary and tertiary.

Research Questions:

1. What are the regional features of China's investment climate?

2. What factors are the determinant of FDI in China (on regional- and sector-level)?

3. What is the effect of the chosen factor (like exchange rate, infrastructure,wage rate, Gross Regional and Industry Product, etc.) on FDI in China? Meaning, towhat extent FDI are increased or decreased by the chosen variables.

....................................

CHAPTER 2 Theoretical Framework on FDI in China

2.1 China's Investment Climate: Nature and Main Characteristics

2.1.1 Theoretical Bases of Research of Investment Processes

At the beginning of the 21st century, the most characteristic quality in the worldeconomy is the high degree of interconnection and interdependence of nationaleconomies among themselves and with the world community as a whole. Investment,as a form of international economic activity, allows us to solve a number of essentialtasks. To conduct a full-fledged study of investment processes, a full understanding ofthe theoretical foundations and conceptual apparatus is necessary.

The term "investment" is defined by a large number of properties andcharacteristics. So, from a legal point of view, investments are primarily an object ofproperty, they are also an object of economic management, market relations. They area source of market for investors. In the most general form, investments arecontributions of capital in all its forms in various business objects by national or foreigninvestors to obtain a profit or other economic or foreign economic effect, theachievement of which is associated with risk factors (Hart, 2013). Experts also classifyinvestments based on the following significant features.

1. Areas of capital investment: real (receiving income in the form of profitfrom business activities) and financial (earning income in the form of a dividend orinterest).

2. The nature of participation in the investment process. Direct - carried outby investing capital in the authorized funds of enterprises, providing the investor withownership or control over the invested enterprise. Portfolio - investing capital in sharesand other securities, making a profit on shares or presence in this industry, and other(medium-and long-term international loans and loans of loan capital, both private andpublic).

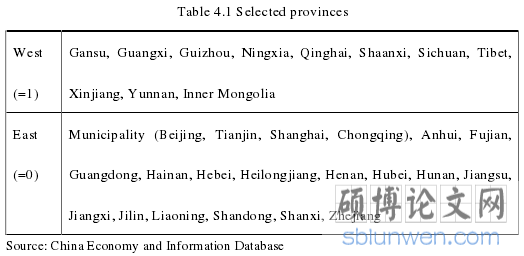

Table 4.1 Selected provinces

2.2 The PRC Investment Climate: Stages and Features of Formation,Current State and Prospects of Cooperation

2.2.1 The Impact of Economic Reforms on the Current State of China'sInvestment Climate

The Ministry of Commerce of the PRC informed Chinese citizens and the worldcommunity in its online statement that: "at the end of 2017, the total volume of foreigninvestment in China increased by 7.9% compared to the previous year to 877.56 billionyuan/136.33 billion US dollars (Zheng, 2019). The statement also says that accordingto statistics for 2017, “35,652 new enterprises with foreign capital were established inChina, which is 27.8% more than in 2016" (Kroeber, 2016). Similar information wasalso provided in the world investment report 2018 by UNCTAD (See Figure 2.1 inAppendix A).

Sustainable economic growth was provided by a variety of factors, includingthe special conditions created in 1978. Agricultural reforms, including the system ofhousehold responsibility, which underwent further changes over the next thirty years,provided a powerful impetus for the new period. China's economic reforms in thetwentieth century contain a vast body of information. In order to understand the impactof reforms on the investment climate, it is necessary to summarize and characterise themain features of economic transformations.

It should be noted that market reforms are pragmatic and effective. The world-famous Chinese strategy 摸着石头过河 (mōzhe shítou guòhé, literally crossing theriver, groping for stones) (Kroeber, 2016), expressed by Deng Xiaoping regarding thegreat reforms and the program of openness to the outside world, inspired localgovernments to take the first steps to implement the reforms. Since the reforms wereimplemented in a gradual, experimental way, this allowed stimulating the localgovernment, and the country as a whole could create workable, transitional institutionsat every stage of development. One of the key features of the reforms was the so-called"duality" of transformations (World Bank).

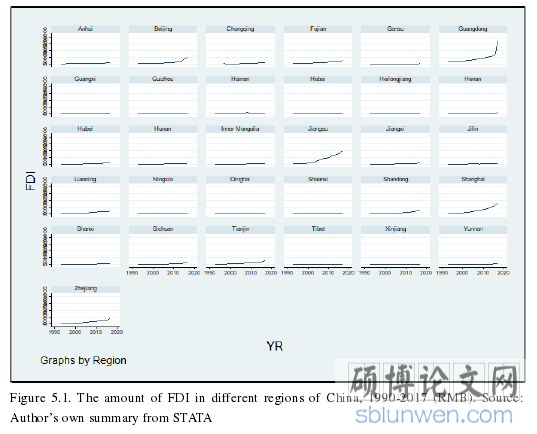

Figure 5.1. The amount of FDI in different regions of China, 1990-2017 (RMB). Source:Author’s own summary from STATA

CHAPTER 3 Literature Review ........................... 49

CHAPTER 4 Research Hypothesis and Model Specification ................ 59

4.1 Research Hypothesis................................. 59

4.2 Data Collection ....................... 61

CHAPTER 5 Empirical Results ........................... 67

5.1 Model 1........................... 68

5.2 Model 2.................................. 73

CHAPTER 5 Empirical Results

5.1 Model 1

In order to account for the differences in FDI allocation decisions across theChinese provinces, was added into our models not only a dummy variable indicatingwest or east region but also such variables as “West” magnified by any other factor(“West * Market Size”, “West * Highways”). This kind of factor specification pursuestwo main reasons:

To identify the key differentiating variables in allocation decisions betweenWest and East;

To be able to use them in the panel analysis, since invariable in time regressorscannot be used in the fixed effects models and “West” is such a variable (equals 1 for“West” and 0 for “East”).

As was mentioned before, it was decided to test 3 models. With logarithms,without and with control variables multiplied with West. LnFDI and lnHighways might be insignificant for our model (with logarithms) as well as Highway and West mightbe insignificant with the model without logarithms, what was expected to be for theFDI. Also, West is negatively related to almost all the factors that were chosen, whatalso was expected.

First of all, the OLS test will be done, as it is a standard procedure to firstreport the results from OLS before moving on to the panel analysis (See Table 5.1 inAppendix E). However, panel data analysis, in contrast to the OLS regression, allowsthe control for the impacts of missing or unobserved factors.

...........................

CHAPTER 6 Conclusion

6.1 Theoretical and Research Findings

China is a unique example with remarkable changes since the announcementof the "Opening-up and Reform" policy in 1978. At the beginning, the reforms offeredto foreign companies to put money in China, but later, the Chinese Governmenthighlighted the significance of FDI. For almost 40 years, Chinese markets are openedto international investments and obtained outstanding results in attracting FDI.Government formed advantageous and profitable conditions for FDI trough creatingSEZ and promoting joint ventures between local and foreign firms. From almost $0 in1978, China reached ~$135 billion of FDI in 2018 with 539,345 foreign enterprisesregistered in China in 2017 (National Bureau of Statistics of China). In the modernhistory of economic development, one can find just a few countries with as muchbenefit from FDI as China have. At present, there is a wide range of academic literaturededicated to the history, determinants and effects of FDI in China (for instance, Chen,1996; Whalley and Xian, 2010, Head and Ries, 1996; Zhao and Zhu, 2000).Nevertheless, in comparison with previous studies on the FDI in China, this thesis isbased on the more comprehensive research with an up to date set and econometricalmodel.

As was noted in the introduction, this thesis examine the factors of FDIdistributions in China and assess the influence of FDI on Chinese national investment.Based on the review of regional features of China's investment climate and thedevelopment of FDI, extensive literature review on prior research on FDI topic,discussion of research methodologies and finally, empirical findings based on theresearch questions, aims and objectives of this thesis. The thesis offers acomprehension into foreign investors’ decision making and the economic costs andeconomic benefits of FDI. It will be useful for scholars, practitioners andpolicymakers. In this concluding section, the empirical findings from the thesis will bediscussed, and then proceed to the possible recommendations for the future researchtopics that could be broadened up from this study.

reference(omitted)

6.1 Theoretical and Research Findings

China is a unique example with remarkable changes since the announcementof the "Opening-up and Reform" policy in 1978. At the beginning, the reforms offeredto foreign companies to put money in China, but later, the Chinese Governmenthighlighted the significance of FDI. For almost 40 years, Chinese markets are openedto international investments and obtained outstanding results in attracting FDI.Government formed advantageous and profitable conditions for FDI trough creatingSEZ and promoting joint ventures between local and foreign firms. From almost $0 in1978, China reached ~$135 billion of FDI in 2018 with 539,345 foreign enterprisesregistered in China in 2017 (National Bureau of Statistics of China). In the modernhistory of economic development, one can find just a few countries with as muchbenefit from FDI as China have. At present, there is a wide range of academic literaturededicated to the history, determinants and effects of FDI in China (for instance, Chen,1996; Whalley and Xian, 2010, Head and Ries, 1996; Zhao and Zhu, 2000).Nevertheless, in comparison with previous studies on the FDI in China, this thesis isbased on the more comprehensive research with an up to date set and econometricalmodel.

As was noted in the introduction, this thesis examine the factors of FDIdistributions in China and assess the influence of FDI on Chinese national investment.Based on the review of regional features of China's investment climate and thedevelopment of FDI, extensive literature review on prior research on FDI topic,discussion of research methodologies and finally, empirical findings based on theresearch questions, aims and objectives of this thesis. The thesis offers acomprehension into foreign investors’ decision making and the economic costs andeconomic benefits of FDI. It will be useful for scholars, practitioners andpolicymakers. In this concluding section, the empirical findings from the thesis will bediscussed, and then proceed to the possible recommendations for the future researchtopics that could be broadened up from this study.

reference(omitted)