本文是一篇财务管理论文,本研究从营运、盈利、融资、成长、现金流和股东分配能力六个方面提出相应的措施,以优化S公司的财务风险管理体系,具体主要包括:(1)营运层面加强应收账款的管理、完善应收账款内控系统;(2)融资层面调整负债结构,建立动态预警机制;(3)成长层面聚焦高附加值产品、深化技术协同与自主创新;(4)盈利层面提升资产运营效率、深化供应链协同与精细化成本管控;

Chapter 1 Introduction

1.1 Research Background

At present,the global home appliance industry is undergoing a period ofstructural adjustment,and the dynamic changes in market competition coupled withthe intensification of macroeconomic uncertainty have placed higher demands on thefinancial risk management of enterprises.As a typical capital-intensive industry,homeappliance enterprises generally adopt a heavy asset operation mode,coupled with thecharacteristics of a long product sales payback cycle,resulting in their financialsituation is very vulnerable to multiple external variables.In particular,demandfluctuations in the end-consumer market often trigger drastic shocks in the company'sinventory level,which in turn causes liquidity utilization pressure.At the same time,the sharp fluctuations in commodity prices and the tightening of the financingenvironment to form a double squeeze,raw material procurement costs continue torise,while bank lending rates further compress corporate profit margins.It is worthnoting that,in the face of industry overcapacity and the double pressure of the marketincremental peak,the head of the overall implementation of production capacityexpansion and technology upgrading strategy,resulting in assets and liabilitiescontinue to rise,financial leverage exceeded the industry warning line,cash flowmatching imbalance problem highlighted.This contradiction between scale expansionand financial soundness has become a core pain point,restricting the sustainabledevelopment of home appliance enterprises.

......................

1.2 Research Purpose

Enterprises must prioritize core business activities,including financing,investment,and daily operations,in order to ensure both regular operations and continuous development.In the course of conducting business operations,it isimperative to implement risk management mechanisms.Financial managers mustidentify potential risks and implement timely countermeasures to achieve riskavoidance.In the context of profound transformations within the global homeappliance industry and mounting economic uncertainties,home appliance enterprisesconfront a multifaceted array of challenges,including their substantial reliance oncapital investment,protracted capital recovery periods,and the accelerating pace oftechnological innovation.As an industry leader,Company S has encountered financialrisks,including but not limited to debt structure imbalance and cash flow mismatch,in the course of its capacity expansion,technological innovation,and global marketexpansion.The present study constitutes a thorough evaluation of the company'sfinancial status,employing an analytical model that encompasses the following threeprimary research objectives:

First,a multidimensional financial risk evaluation model based on the entropyweight TOPSIS method is constructed to quantitatively identify the key drivers of SCompany's financial risk and reveal its risk transmission mechanism from sixdimensions,namely,financing ability,operating ability,profitability,growth ability,cash flow ability,and shareholder profitability.

...........................

Chapter 2 Theoretical Background and LiteratureReview

2.1 Definition of Key Concepts

2.1.1 Financial Risk

Lan(1999)points out that financial risk contains both broad and narrowcategories.Financial risk in the narrow sense refers to the repayment crisis that ariseswhen an enterprise is unable to repay the principal and interest on time in the processof debt financing.Financial risk in the broader sense covers the accumulation of riskscaused by external shocks such as changes in macroeconomic policies andfluctuations in the market environment,as well as internal and external factors such asomissions in inventory control,inappropriate financing strategies,and imbalances inthe capital structure,which lead to uncertainties in the operation of the enterprise.Such risks not only erode the returns of investors and stakeholders,but also interferewith the formulation of corporate strategic decisions,and even pose the potentialthreat of unrealized returns.Enterprises have been facing the accompanyingcharacteristics of financial risks since the beginning of their business activities,sothey need to continuously monitor the sources of risks and formulate risk controlplans through scientific assessment,in order to minimize the potential threats.Thisstudy analyzes the case companies from a broad financial risk perspective.

财务管理论文怎么写

......................

2.2 Overarching Theories

2.2.1 Risk Management Theory

Risk management theory is based on the objective existence and uncertainty ofrisk,aiming to cope with all kinds of financial risk challenges in enterprise operationthrough systematic measures.Its core includes:timely identification of risk sources,adjustment of risk direction,reduction of risk frequency,prevention of repetitive risks,and ensuring the stability and safety of capital flow through management actions.During the Great Depression in the United States of America in the 1930s,survivingenterprises survived through the reform of risk management,and this practice pushedforward the academicization and systematization of risk management theory.Traditional risk management is mostly led by financial or internal audit departments,focusing on risk transfer or avoidance;while modern comprehensive risk management is coordinated from a strategic height,requiring management and all staff toparticipate in risk governance,covering the whole process of decision-making,execution and supervision.In order to ensure the continued stability of the enterprise'scapital chain,it is necessary to scientifically investigate the sources of risk and build adefense system through risk identification,assessment and control.Effective riskmanagement not only optimizes resource allocation and reduces operating costs,butalso prevents potential losses and supports sustainable development.Based on thistheoretical framework,the following article will analyze the enterprise financial riskresponse strategy and put forward optimization suggestions.

Liu(2024)argues that state-owned enterprises face problems such as backwardconcepts and imperfect internal control mechanisms in financial risk management andcontrol.The theory of comprehensive risk management emphasizes that enterprisesimplement risk management in all operational aspects,which is strategic,all-embracing and systematic in nature.It also proposes that state-owned enterprisesshould improve the level of financial risk management and control by establishing theawareness of comprehensive risk management and improving the internal controlmechanism and other strategies.An&Li(2021)argued that strategies to improve thequality of financial risk management need to enhance the awareness of financial riskcontrol,establish a perfect financial management system,set up a scientific andefficient risk response system and improve the professionalism of enterprise financialmanagement personnel.

........................

Chapter 3 Introduction of Company S...............................26

3.1 Background of the Home Appliance Industry...............................26

3.2 Reasons for Choosing Company S as a Case Study......................29

3.3 Current Situation of Company S............................30

Chapter 4 Financial Risk Identification of Company S......................37

4.1 Current Situation of Financial Risk Management..........................38

4.2Financial Risk Identification......................40

Chapter 5 Financial Risk Evaluation of S Company Based on Entropy WeightTOPSIS Method............................58

5.1 Construction of Financial Risk Evaluation Index System.............................58

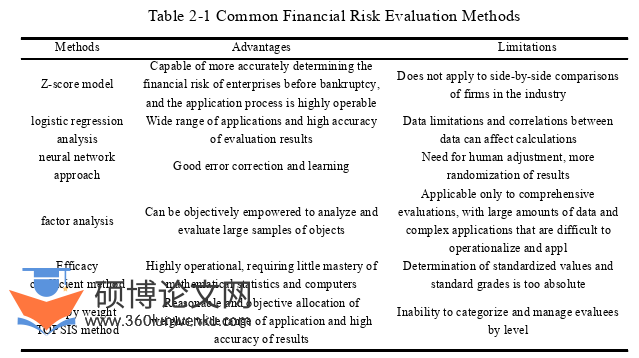

5.1.1 Reasons for Choosing Entropy Value TOPSIS Method............................58

5.1.2 Principles and Bases of Indicator Selection.......................63

Chapter 6 Recommendations on Financial RiskManagement and Control for Company S

6.1 Measures for Controlling Operational Risk

The accounts receivable turnover ratio is a key indicator of operating capacity.From 2019 to 2023,this metric declined from 11.27 to 8.90—a drop of 21.0%—witha coefficient of variation of 0.15,indicating a sustained deterioration in managementeffectiveness.This trend suggests that the risk is becoming increasingly pronouncedand falls into the category of high-importance and high-probability core risks.

6.1.1 Strengthening the Accounts Receivable Management System

Management should enhance the company’s ability to realize accountsreceivable in order to improve the turnover rate of current assets.Timely financialanalysis should be conducted to identify problems,forecast potential scenarios,and mitigate exposure to risk.Specifically,Company S should establish a differentiatedcredit evaluation system for customers based on their credit profiles.Customersshould be objectively and accurately scored,and then categorized into tiersaccordingly.Different credit limits should be granted based on these tiers.Within theauthorized credit limit,customers may defer payments.Real-time monitoring shouldbe implemented,with reduced credit lines for customers exhibiting credit violationsand expanded credit limits and relaxed policies for customers with consistently soundcredit performance.This approach helps prevent overly conservative credit policiesfrom stifling sales—where turnover improves,but growth declines,leading to reducedrevenue.

财务管理论文参考

..........................

Chapter 7 Conclusions and Futural Research

7.1 General Conclusions and Managerial Implications

This study takes a case study of a home appliance manufacturing company,SCompany,to systematically diagnose its financial risk from 2019 to 2023 in fourdimensions:financing structure risk,operational efficiency risk,profitabilitysustainability risk and development momentum risk.Based on the risk identificationresults,we further construct a financial risk assessment framework that includes sixmodules:financing,profitability,operation,development,cash flow and shareholders'equity,and use the entropy weight-TOPSIS model to quantitatively assess the level ofS Corporation's financial soundness.Finally,the study proposes targeted financial riskmanagement strategies to optimize the corporate risk governance path in light of thecurrent situation of the company's operations.The research conclusions are asfollows:

(1)In this chapter,by combing through the current situation of financial riskmanagement of S Company,based on five consecutive years of financial data from2019-2023,key indicators such as current ratio,accounts receivable turnover,returnon net assets,etc.,were used to make a preliminary identification of its financial riskin four dimensions:financing,operation,profitability and growth.It is found that SCompany's debt repayment pressure increases;accounts receivable managementeffectiveness decays;inventory control fluctuation increases;net profit growth ratefluctuates significantly and the growth momentum is insufficient;and capital strength and development potential are not high.

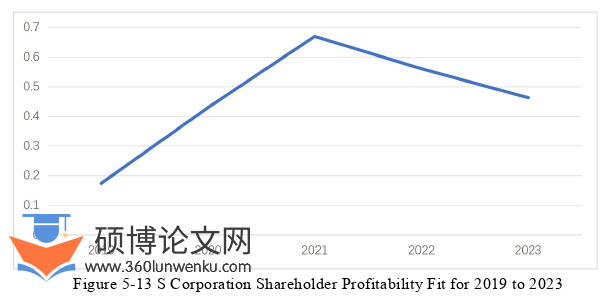

(2)Financial risk assessment system is constructed.Based on the results of riskidentification in the previous sequence,22 risk assessment indicators are selectedfrom six modules,namely,financing structure,profit quality,operation efficiency,development momentum,cash flow and shareholders'equity,and a multi-dimensionalevaluation index system is constructed.Comprehensive assessment is conductedthrough the entropy weight-TOPSIS model,and the quantitative results show that thefinancial robustness peaks in 2019,the risk level bottoms out in 2021,and althoughthere is a significant improvement in 2023 compared to 2022,it has not yet recoveredto the benchmark level in 2019.

reference(omitted)