CHAPTER ONE – INTRODUCTION

1.1 Study Background and Statement of the Research Problem

1.1.1 Background of the Study

Financial reports are often viewed as a company's most significant reporting event because they provide useful details about the companies' operational and financial performance. In response to high demand from stakeholders such as managers, employees, customers, and especially governments, creditors, and investors, financial reporting has undergone various remodeling. High quality of financial reports shrinks the gap of asymmetry information of the corporation's current execution between internal and external stakeholders. Consistent with Gebhardt, Mora, and Wagenhofer (2014), Financial reporting should give information that is beneficial to present to potential investors, creditors and other users in making a justifiable investment, credit, or similar decisions. The information should be understandable to those who have a reasonable knowledge of business and economic transactions and are willing to examine the information with reasonable diligence.

While preparing financial reports, it is essential to keep in mind that a corporation or independent auditors will review them. Thus, financial reporting should follow the rules and guideline according to the International Financial Reporting Standards (IFRSs), which are comparable, understandable, reliable, and relevance. These characteristics will make the reports more valuable for internal or external users.

............................

1.2 Significance of the Study

Financial reporting can be considered a representation of the financial health of companies. Nowadays, new businesses are in demand for financial analysis and reporting as the backbone of the businesses. Either because it is a mandatory requirement in most countries or because, without it, firms cannot increase their capital. Financial reporting is a standard application that provides stakeholders rigorous foresight of a company’s economic situation, such as revenue, expense, profit, cash flow, capital, and liability. It is a formal record that gives the best in-depth observation of financial information. Besides, it provides with trend information which is very useful for tracking diverse financial activity, including the past, present, and future predictions. For instance, financial reporting quality can increase the level of investment efficiency and make it more predictable for investment decision (Gary C. Biddle, Hilary, & Verdi, 2009).

Financial reporting is closely related to auditing because a company cannot release a report to the public without checking its accuracy. For understanding a company auditing, it is essential first to learn about its reason, and the role played by the independent auditors.

Audit quality is crucial because it will affect the credibility, accuracy, and reliability of the audit opinion. If the auditors display a shoddy auditing work, the opinion delivered about the audited financial statements could be misleading and miscommunicating, and this would eventually affect the economic decision of the users. In this discourse, audit quality is known to protect the economic interest of the owners and other interested parties by enhancing the quality of information of the financial statements prepared by the managers.

.........................

CHAPTER TWO - LITERATURE REVIEW

2.1 Introduction

Financial reporting quality is a topic which has been studied and debated over endlessly. It is still a concerning issue for users of financial reporting whether the financial disclosure obtained is accurately represented financial health of the company. Financial reporting is not just ordinary financial statements which contain an only balance sheet, income statement, statement of cash flow, and statement of changes in Equity. It conveys more detail and complex meaning. Quality of information is a qualification to which financial report is prepared under sound judgments, facts, and free from misstatement and exaggeration.

Auditing is a procedure established by the accounting board to ensure that financial reports provide relevant and reliable information to the interested people of an organization and the public. The practices vary from one audit firm to another depending on their sizes, nature of activities, and national legislation. The literature documents various opinions as to what factors are contributing to audit quality.

This chapter discusses the introduction to financial reporting quality, the concept of International Financial Reporting Standard, auditing: definition, importance, objectives, and auditing quality.

.............................

2.2 Financial Reporting Quality

Financial reporting aims to present essential financial information to the interested party such as potential equity shareholders, lenders, and other creditors in making choices in their capacity as capital providers (Whittington, 2008). Financial reporting is the conversation that enables users of financial statements to examine the profitability and the economic situation of a company.

Financial reports are required by law for tax administration purposes. It is a tool for the government to oversee the companies' act whether they have paid the tax in a fair share by utilizing such reports. There are a number of papers which investigated the relationship between financial reporting and taxation and came out with similar conclusion that tax liability does have effect on how financial reports are organized (Brown, Jorgensen, & Pope, 2019; Lynch, Romney, Stomberg, Wangerin, & Robinson, 2018; Mao & Wu, 2019). Countries of non-IFRS mandatory adoption have higher tax avoidance compare to countries with IFRS mandatory adoption (Farrar, Hausserman, & Rennie, 2019).

High financial reporting quality can bring about fund rise to its maximum by attracting people who are willing to invest in the business in the form of trading stock to the general public. This is an excellent way for firms to increase capital without paying any interest. This fact has been proved by Jia (2018), whose study showed that financial disclosure affects stock which influent on corporate managers to use disclosure strategies to increase the quality of financial disclosure. This creates an incentive to release good news and hold back lousy news to deliberately inflate stock prices (Weisbrod, 2019). The corporate practice behavior of disclosing good news and withholding lousy news has a weak report of earning forecast (Ali, Liu, Xu, & Yao, 2019).

................................

CHAPTER THREE - CAMBODIA’S STANDARDS, STATUTORY FRAMEWORK, AND BANK INDUSTRY .......... 28

3.1 Cambodia Accounting Standards, Rules and Regulations ............................. 28

3.2 Cambodia Statutory Framework and Oversight for Auditing ...................... 28

3.3 Cambodia’s Bank Industry ................................. 31

CHAPTER FOUR – THEORY ANALYSIS AND HYPOTHESIS DEVELOPMENT ..................... 33

4.1 Theory and Hypothesis of Financial Reporting Quality ......................... 33

4.1.1 Fundamental Concept .................................. 33

4.1.2 Enhancing Concept ........................................ 33

CHAPTER FIVE - METHODOLOGY DEVELOPMENT ...................................... 42

5.1 Study Area .............................................. 42

5.2 Research Design ................................................ 42

5.3 Population of the Study ..................................... 42

CHAPTER SIX - DATA PRESENTATION AND ANALYSIS

6.1 Introduction

This chapter concerns about variable description, analyzing of the data including descriptive statistic and result presentation. The data was tested and presented using tables.

After the data has been collected, it is later being process by using the Statistical Package for Social Science (SPSS) software and Microsoft Excel 2010. The last part of the chapter is the discussion of result of finding which is processed by SPSS.

..............................

CHAPTER SEVEN – CONCLUSION, LIMITATIONS AND RECOMMENDATION

7.1 Conclusion

The objectives of the investigation have two main goals. The first one is to measure the compliance of financial reporting of banks in Cambodia whether IFRS is fully implemented. Since Cambodia Accounting Standards (CAS) is compelled with the International Financial Reporting Standards, it is expected that financial reports of banks in Cambodia should be high in quality. In order to access this object, the researchers constructed a model based on the conceptual framework of IFRS which also had been used to demonstrate the quality of financial reporting in many previous literature such as (Ferdy Van Beest et al., 2009; Cuong & Thi Ly, 2017; Ghofar & Saraswati, 2009). The method employed was able to explain well about the financial reporting quality. However, the result from the investigation does not support the above assumption. It is found that financial reports of banks in Cambodia is moderately adopted IFRS in preparing those reports. Moreover, it shows that financial reporting in Cambodia need more improvement which should start from providing more information about consistency of the financial reporting by adding information about changes in accounting policies and estimates, and other information that is useful for comparing within the same industry such as competitors, companies’ shares and financial index and ratios.

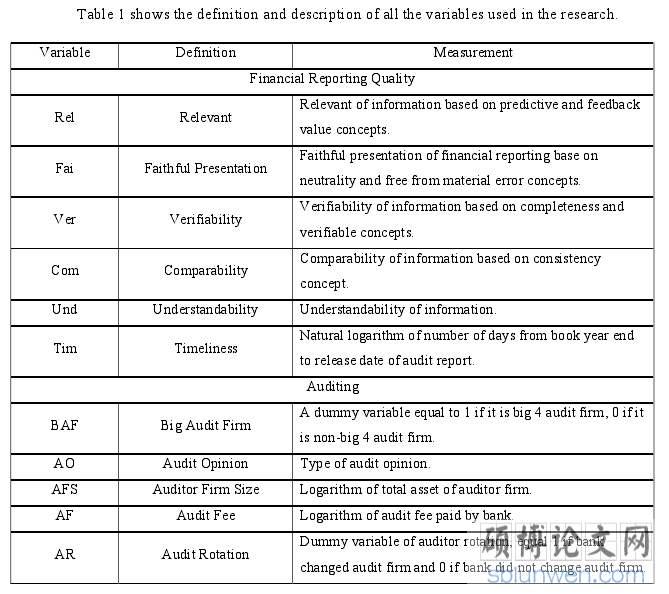

The second objective is to find if there is a relationship between auditing and financial reporting quality in Cambodia. The researchers initiated the investigation by forming a framework which associate with auditing and subsequently was able to create its determinations. Those are big and non-big 4 audit firms, audit opinion, audit fee, audit firm size and auditor rotation. Based on these conditions, the researcher form a model to analyze the relationship between these variables and financial reporting quality. It is expected that the variables have significant relationship with financial reporting quality. However, it is shown that not all the variables can interpret relationship between auditing and financial reporting quality well. Audit opinion and audit rotation are able to explain very well as they have p-value < 0.01 which mean they have positive significant relationship with financial reporting quality. Big vs. non-big 4 audit firms is moderately able to explain well as it has p-value between 0.01 and 0.05 which means it has also have positive significant association with financial reporting quality too.

reference(omitted)

7.1 Conclusion

The objectives of the investigation have two main goals. The first one is to measure the compliance of financial reporting of banks in Cambodia whether IFRS is fully implemented. Since Cambodia Accounting Standards (CAS) is compelled with the International Financial Reporting Standards, it is expected that financial reports of banks in Cambodia should be high in quality. In order to access this object, the researchers constructed a model based on the conceptual framework of IFRS which also had been used to demonstrate the quality of financial reporting in many previous literature such as (Ferdy Van Beest et al., 2009; Cuong & Thi Ly, 2017; Ghofar & Saraswati, 2009). The method employed was able to explain well about the financial reporting quality. However, the result from the investigation does not support the above assumption. It is found that financial reports of banks in Cambodia is moderately adopted IFRS in preparing those reports. Moreover, it shows that financial reporting in Cambodia need more improvement which should start from providing more information about consistency of the financial reporting by adding information about changes in accounting policies and estimates, and other information that is useful for comparing within the same industry such as competitors, companies’ shares and financial index and ratios.

The second objective is to find if there is a relationship between auditing and financial reporting quality in Cambodia. The researchers initiated the investigation by forming a framework which associate with auditing and subsequently was able to create its determinations. Those are big and non-big 4 audit firms, audit opinion, audit fee, audit firm size and auditor rotation. Based on these conditions, the researcher form a model to analyze the relationship between these variables and financial reporting quality. It is expected that the variables have significant relationship with financial reporting quality. However, it is shown that not all the variables can interpret relationship between auditing and financial reporting quality well. Audit opinion and audit rotation are able to explain very well as they have p-value < 0.01 which mean they have positive significant relationship with financial reporting quality. Big vs. non-big 4 audit firms is moderately able to explain well as it has p-value between 0.01 and 0.05 which means it has also have positive significant association with financial reporting quality too.

reference(omitted)