Chapter1: Introduction

1.1 Background

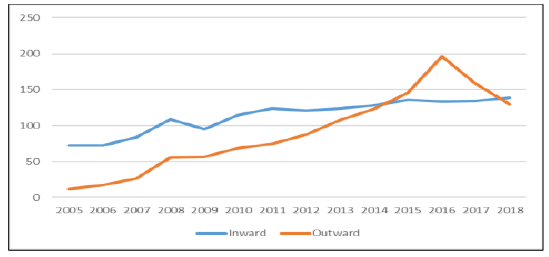

When China came into being and during coming years China‟s economic development was slow but after Chinese economic reforms and its openness to the world has changed the fate of China economic development and there was seen rapid increase since 1978. In the start of 1980s, there are very less scope for the outward FDI, which was based on few sectors like Transport services, Engineering, Catering services and financial insurance but after 1984 there was seen huge developments and the investments abroad increased by the Chinese government and later in 1987. Hong Kong alone became their largest investor with amount of 10 billion US$.

History is the best alternative to analyze any issue, the same in the case of China history will play its role of analyzing where the current issue has made Chinese exports, the history of Chinese OFDI policies and its export will help us know the essentials.

As we look from the start when in 2000s when the China‟s direct investment started so it was annually below dollar 3 billion before 2005, but before 2006 it was dollar 20 billion and by 2008 it was dollar 50 billion. By December 2011 China‟s total global outward Foreign Direct Investment (OFDI) stock was at dollar 365 billion and this all investment in start was in developing countries and resource wealthy developed countries for instance Canada and Australia and there were very less investments and most advanced economies till 2008. We cannot close our eyes that there is very tiny share for China in USA but the trend is going on. There was an assessment that Chinese firms are operating in 37 of 50 states in US industries.

..............................

1.2Aims and objective of the study

After explaining background and by explaining the Chinese OFDI developments, we can now easily know our aims of this thesis, we can easily draw a line that how Chinese OFDI impact exports or why they are not doing well, by this thesis we will try to answer these questions, how OFDI‟s are impacting on the export quality of the country, which link does OFDI impact export and if OFDI are weak so how can they become strong enough which can positively impact the exports of China.

As deeply explained above with giving such example that countries with strong OFDI have been seen in increasing exports and countries which have weak OFDI have very less exports, , in this instance China is taken as the study, to know that how much important OFDI is for the export performance as China‟s export is quite low since long. So the study has the following objectives:

1. To collect, investigate and compare the evidence for Outward Foreign Direct Investment contributes to exports in China?

2. To explore what is the impact of OFDI on exports of China?

3. To propose suitable policy implications for the enhancement and efficient use of OFDI in the exports of China.

Figure 1: Estimates of China’s Annual FDI Inflows and Outflows: 2005-2018 ($ billions)

Chapter 2: Literature Review

2.1 Export Platform Outward Foreign Direct Investment:

There is another phenomena known as „Platform OFDI‟, in which the worldwide production and the splitting of labor, which helps original enterprise to make links in the country they are investing and the final good are exported to the third country, this phenomena is used in this regard(Ekholm, 2007)

The platform OFDI plays a very important role three dimensional effect, with respect to traditional OFDI which are more into the local markets or the original country but platform OFDI more specifically defines the OFDI activities and strategies more soundly and in affective way, (Neary, 2002),(Yeaple, 2003), (Ekholm, 2007)supports the platform FDI.Platform FDI via trade off helps host country in less production cost, FDI and trade costs, different literature have concluded the behavior of platform FDI in this sense(Hanson G. R., 2005).

According to a literature it depends on the region to region which has concluded that export Platform FDI has a negative effect among the FDI of one specific area and the other regions around, though National Economic Geography stresses the export platform which is produced by the third party or country has also effect, which unite the different causes of heterogeneity and it goes into critical structure of economics and that has strong impact on the OFDI certainly (Blonigen B. R., 2007)

Though due to high cost of international shipping, duties and several other factors, there is problem for export firms but as the fixed rate is fixed of these factors so the situation becomes suitable for the domestic markets, creating industries on foreign land is very expensive but the marginal rate is not high which is helpful for the market insistence (Buckley P. J., 1981).

...........................

2.2 Chinese Outward FDI- (special features & characteristics)

If we talk specifically about activities related to Chinese investment so they are as same as are of developing countries but there is different in standard model of FDI which is of the countries which are emerging(Holt, 2008)(Buckley P. J., 2008), all most of the researchers are attracted to the flow of FDI from emerging economies(Child, 2005)(Miller, 2008),(LUO, 2007). The FDI activities from the developed countries are in a way that they may take full advantage of ownership but if we talk about the activities from developing countries, so they are not in that way that they may take full advantage of the assets or from the ownership and same is the case with Chinese investment firms (Athreye, 2009).

The Chinese FDI consists of three features, which are capital market limitations, precise ownership compensations and institutional features, these features are conflicting to the FDI theories and the theories from the countries which are developing economies(Buckley P. J., 2007).

Chinese investment is being affected by the resources market deficiencies in different directions, though in China the government is controlling the banking system, due to which state owned firms are able to get funds easily plus with low market price(Warner, 2004). Risky short interest loans and subsidies for the investors are likely to be facilitated by the inefficient banking system, due to the local government and central government pressure party(Child, 2005).

As there are different advantages including ownership advantage for the Chinese firms in developing countries respectively, which can witness more experience of Chinese firms in the developing countries, this experience have added more into Chinese firms to perform into more intense grounds like corruption, poor institutions and etc., but still they can perform well and are more successful in developing countries if compare to the western firms(Kolstad, 2012).

............................

CHAPTER 3: THE DESCRIPTIVE ANALYSIS OF CHINESE OFDI AND EXPORTS....................................... 24

3.1 AN OVERVIEW: ............................. 24

3.2 OFDI AND CHINA’S EXPORT PERFORMANCE .............................. 25

3.3OFDI AND EXPORTS TO OECD COUNTRIES IN PARTICULAR ............................. 27

CHAPTER 4: RESEARCH METHODOLOGY .......................... 32

4.1DATA SOURCES COLLECTION ........................... 32

4.2MODEL .................................... 32

4.3TECHNIQUES ................................ 33

CHAPTER 5: RESULTS AND DISCUSSION ...................... 36

Chapter 5: Results and Discussion

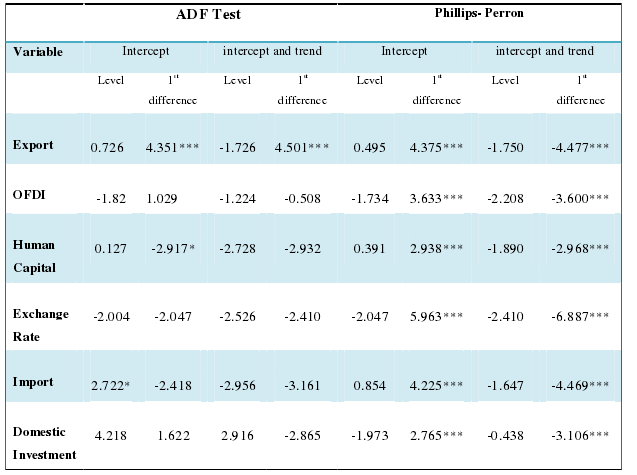

In this section we will analyze the results we attained from later tests will describe and explain the empirical findings, how those tests were done and what tests were used to analyze the data is already discussed in Chapter 4. The order of the tables will be according to the tests applied to the data. To recognize if the variables are stationary or not, we applied root unit tests to obtain the results, the Augmented Dickey-Fuller unit root test, and the Phillips-Perron Unit root test were used to obtain the required results.

Table 5.1 shows the results of unit root. The entire test, e.g. ADF, PP indicate that the underlying variables of the study are integrated of I (1), I (0) and mix of the both. Therefore, it allows us to apply ARDL methodology.

Table 5.1: The ADF and Phillips-Perron Unit Root Test Results

Chapter 6: Conclusion

This thesis is presenting the detailed study of the impact of OFDI on exports empirical evidence from China, in which ARDL model and time series data are used, different literatures has been studied to know the realities and to get points of most of the researchers in different perspectives.

The variables were taken such as exports which are dependent variable, Outward Foreign Direct Investment (OFDI), Exchange Rate (ER), Human Capital (HC), Domestic Investment (DI) and Import (IMP) are independent variables, and these variables have been taken to know the collision of OFDI on export performance of a country.

The study has witnessed that OFDI has positive influence on the export performance of a nation, OFDI are playing the role of driving force for the export betterment of a country. The China‟s trade features are OFDI, which is export sustaining and export policy and the OFDI dependency on the exports, the dependency of China‟s OFDI on exports is shown in our results which explains the importance of exports for the China‟s OFDI, which in simple words we can say that exports are driving force for the China‟s OFDI, furthermore the foreign sales are supported by the export supporting OFDI, export supporting OFDI is also playing an essential role in the host countries with respect to levels of income.

To increase home capital for exports, by transferring technology and new products for exports, by smoothening ways for new and big foreign markets, by giving updated training, technical and management skills to the locals. Though there has been witnessed a positive impact but there are different suggestions also given with respect to FDI which are (a) there should be home savings and investments, (b) not to shift those technologies which are not suitable in any way for the host country, (c) not to target only host country‟s host market as well as not to increase exports, (d) not to expand those firms which are able to become exporters later, (e) not to help the host countries which have all the focus on the cheap labor and raw materials.

reference(omitted)