Chapter 1 Introduction

1.1 Background of the study

Foreign trade is the trade relations of a country with others, which consist of exports and imports. The totality of foreign trade relations between different countries forms international trade. As part of this trade over time formed an international division of labor, which is the basis of international trade relations. International trade development is one of the priority directions of the Russian economy, because the external trade is directly involved in the process of injection of foreign currency to the inbound country's economy. External trade is a key of efficient country’s development at all and it requires special characteristics such as: factor endowments, income levels, level of development, product differentiation, foreign direct investment, etc. International trade is an important tool for the development of the national economy, as it increases productivity, increases the total volume of production. States that export their goods to other countries receive a significant economic benefit from the development of specialized industries, which have a relatively higher efficiency compared to countries that produce similar products[21].

Russia's foreign trade is influenced by both external and internal factors that influence the formation of the country's foreign trade. Among the internal factors are: the geographical location and the vast area of the country, which allows to develop trade and economic relations with the EU, CIS, China and other countries; a significant reserve of natural resources; relatively low cost of labor resources with a high average level of education of the population; highly qualified personnel and availability of domestic advanced developments in the field of defense industry, shipbuilding, nuclear industry. Among the external factors there are: participation in trade and economic alliances (WTO, CIS, BRICS, APEC, the Eurasian economic community, and others); the global oil prices, energy resources, fluctuations in exchange rates; the low proportion of the interest of international investors in investing in high-tech, cultural and social projects, risks of economic and political distability[25].

.........................

1.2 Statement of the problem

In a multi-country, multi-product and multi-factor world, one may expect to generate intra-industry trade (IIT) on a multilateral basis. Indeed, the majority of the empirical studies are on a multilateral basis, although a number of such studies are based on bilateral trade[4]. Thus, this study examines IIT between Russia and the main trade partners especially from Commonwealth of Independent States (CIS), European Union (EU) and Asian Pacific Region (APR), using a balanced panel with 10 trade partners for the period 2014–2018. The novelty of the research is explained by application of the panel data method for analysis of Russia’s IIT with the main trade partners.

It is stressed that what follows is a discussion of various hypotheses relating country-related determinates of IIT and results of panel data regression analysis - Fixed-Effects (FE) and Random-Effects (RE) estimators are used, but the problems with this type of applied work arise because in these model’s serial correlation, heteroscedasticity and endogeneity of some explanatory variables do occur and the estimators used do not take this into account whether the regression analysis is carried out at one-digit level industry groups. In this occasion, in this paper, we are not attempting to testify any specific theory of IIT but rather ascertaining a number of determinants of IIT in manufactured commodities [7].

.............................

Chapter 2 Analysis of Russia’s international IIT

2.1 Extent of Russia’s bilateral IIT

The explanation for the existence of intra-industry trade is based on the application of a monopolistic competition model to international trade and the assumption of economies of scale. In different countries, for industries that produce the same goods in monopolistic competition markets and have economies of scale, the development of international trade means an increase in the market and, consequently, an increase in production, while reducing costs as a result of the use of economies of scale. At the same time, competition in the international market leads to the specialization of a particular industry in separate types of products and to an increase in the range of consumer goods of the industry in the markets of the two countries.

Moreover, the specialization of industries in production is possible mainly due to technological innovations. In turn, economies of scale in the context of expansion of production leads to a return on innovation. In addition, the scale effect contributes to accelerated recovery of costs of production, which entails increased investment in the improvement of production. At the same time, the already improved product enters the world market not only by reducing unit costs and increasing labor productivity, but, most importantly, by means of a technological monopoly, which arose as a result of innovative development based on investment of funds received as a result of faster payback periods. Technological monopoly on the production of a certain product justifies the existence and development of intra-industry specialization in production, which in the international exchange of goods manifests itself as intra-industry trade.

.........................

2.2 Measurement of IIT

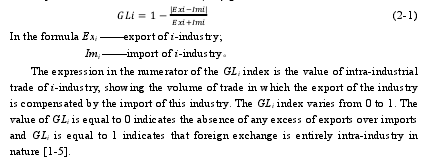

A variety of alternative measures have been purposed in the literature to estimate the degree of intra-industry trade (IIT). Among them the most widely adopted measure in international economics has been developed by Grubel and Lloyd, which is therefore, known as Grubel-Lloyd (GL) index[14]. They measured intra-industry trade as a percentage of country’s total trade which was assumed to be balanced, that is exports equal imports. For an individual product group or industry i the share of IIT as formula (2-1) gets:

..............................

Chapter 3 Econometric model building ........................ 29

3.1 THE DETERMINANTS OF THE IIT AND RELATED HYPOTHESES ..................... 29

3.2 MODEL SPECIFICATION ...........................30

Chapter 4 Estimation results and recommendations ....................... 42

4.1 RESULTS OF THE ANALYSIS .............................. 42

4.2 RECOMMENDATIONS FOR THE FUTURE RESEARCH ................................... 49

Chapter 4 Estimation results and recommendations

4.1 Results of the analysis

In this Chapter, we are to analyze and interpret the results of the estimated Random-Effect Model. Due to the considered hypotheses we have designed above, we are to approve or disapprove the next statements (based on the Table 3-1):

(1) Economic size value similarity as a negative variable for the IIT explanation.

According to this statement, as the differences between economic sizes of countries rise, the extent of IIT should, on the contrary, decline. Due to this the explanatory variable coefficient – DPCit – is an average GDP difference value between the two countries, which means as APC rises, the IIT value decrease. Thus, it should be positive and the Probability Value of the variable is to be significant (i.e., more than 5%).

(2) Income level similarity as a positive variable for the IIT explanation.

Due to the consideration above, if income difference between two countries is low, then the rate of intra-industry trade would be high because the demands of two countries are becoming similar. Thus, the explanatory variable coefficient APCit – an average GDP per capita difference between two countries – is to be positive and the Probability Value of the variable is to be significant (i.e., less than 5%).

.............................

Conclusion

To conclude, the current study was studying the features of the international intra-industry trade in Russia, i.e. it’s current trends and potential development. As we have found out, the explanation of the existence of intra-industry trade is based on the application of the model of monopolistic competition to international trade and the assumption of the existence of economies of scale. In a multi-country, multi-product and multi-factor world, one may expect to generate intra-industry trade on a multilateral basis. Indeed, the majority of the empirical studies are on a multilateral basis, although a number of such studies are based on bilateral trade.

Analysis of the development of intra-industry trade in Russia in the sectoral context shows the presence of a steady decrease in its intensity. This is the result of the existing differences in the level of technological development of Russia and developed countries, which account for a large share of Russian trade. Technological backwardness of the country is characteristic, first of all, for mechanical engineering, in any of the sub-sectors of which there is no development of intra-industry trade. Differences in the level of technological development make it possible to increase the intensity of intra-industry trade only in industries with average knowledge intensity, which is observed in the calculation of the intensity of intra-industry trade in the context of sub-sectors of the manufacturing industry.

reference(omitted)