CHAPTER 1: INTRODUCTION

1.1 Introduction and Background

Over the past few decades, FDI has remarkably increased throughout the world, exceeding the growth of international trade and world production (Herzer and Klasen 2008, Simionca 2013). It has experienced a continuous increase exceeding other international trade transactions, which ultimately makes it the prime economic transaction across the globe (Graham and Krugman 1993). Most importantly, the increase is noteworthy for the developing countries, where it has become the most stable and largest component of capital flows (Alfaro, Chanda et al. 2004). Its importance has enforced the countries to adopt favorable policies in order to attract more FDI and to access modern technologies. In this context, developing countries created a history in 2012 for the very first time and received more FDI than developed countries. A total of nine development countries secure their position in the list of twenty largest FDI recipients in the world (UNCTAD 2013). The importance of FDI has revitalized the debate about its costs and benefits and several developing countries are taking measures to attract higher FDI flows based on this supposition that it is an important stimulus for economic growth (Aykut and Sayek 2007).

Manufacturing has traditionally played a key role in the economic growth of developing as well as the developed countries. Development of any country is largely reliant on its manufacturing sector of the economy (Szirmai 2012). Historically, it has been proved to be the driver of economic growth and it is no more considered as the corner stone (Naudé and Szirmai 2012, Herman 2016). In general, manufacturing sectors, difficult and sluggish recovery into an economic revival (Adugna 2014). A study conducted by Kuznets et al. (Kuznets and Murphy 1966) described that an increased share of manufacturing in GDP is a key factor of modern economic growth and it is regarded as the main engine of fast growth. It is also noteworthy from the recent studies pertaining to China and India that even in the manufacturing sector, a larger proportion of total FDI inflow is invested in the high-tech industries (Caves and Caves 1996). Over the years, the high-tech industries making it approximately 70% of the total FDI into the manufacture sectors (He Feng, Yuan Xiaoan, 2010). However, generally an increasing trend of FDI has been observed in both the countries in the overall manufacturing sector. In this context, impact of FDI on manufacturing sectors is vital importance for any country. Most of the countries attempt to attract FDI in the manufacturing sector due to its acknowledged advantages as an economic development tool (Akinlo 2004). Role of FDI in manufacturing is often regarded to be positive and is equally important to stimulate the growth in the manufacturing sector as well as the other vital sectors of the economy (Sokunle, Chase et al.).

................................

1.2 An Overview of the FDI in Different Sectors of the Economy of China and India

Table 1.1 provides an overview of the FDI inflow in different sectors of Chinese economy. That are presented in 10000 million US$ and covers the statistics from 1997 to 2017. Each section will be described very briefly as the focus of the thesis work is on the manufacturing sector. It can be seen from the Table 1 that agriculture, forestry, animal husbandry and fishery have seen no significant increase and in fact it firstly reduced from 1997 to 2007 which again slightly increased during the period from 2007-2017. However, mining has seen tremendous increase and the figures have almost doubled in 20 years despite of the fact that during first ten years it severely dropped. The details of the remaining segments of the economy can be found in Table 1.1.

It can be seen from the highlighted text that from the 1997 to 2007, Chinese manufacturing sectors has seen tremendous growth and the FDI had almost doubled in 10 years from 1997 to 2007. However, it again decreased significantly but overall there is an increasing trend of FDI in the manufacturing sector for the entire period of two decades (1997-2017).

..............................

CHAPTER 2: LITERATURE REVIEW

2.1 Impact of FDI on Manufacturing Sector

This section seeks to explore the contemporary evidences around key themes that have been found in recent literature to have an insight into the FDI impact on the manufacturing sector. Organization for Economic and Development (OECD) defines FDI as follows

“An investment that reflects the objectives of obtaining a lasting interest by a resident entity in one economy (“direct investor”) in an entity resident in an economy other than that of the investor (“direct investment enterprise”). The lasting interest implies the existence of a long-term relationship between the direct investor and the enterprise and a significant degree of influence on the management of the enterprise” (OECD, 1996, pp7, 8)

It is noteworthy that empirical evidences of FDI on economic growth are rather inconclusive, however, Kolstadet al. (Kolstad and Wiig 2011) and Gudlaet al.(Madem, Gudla et al. 2012) stated that FDI is one of the drivers of economic growth and poverty alleviation in the developing countries. L.C. Arango Vieira (Arango Vieira 2009) argues that the economy grows due to capital accumulation and generation of positive long-term spillovers to various stakeholder groups due to an interaction between the FDI and the host country. On the contrary, some authors rather emphasis on the negative effects of FDI. In this context, Adam (Adams 2009) and Moyo (Moyo 2009) stated that developing countries can probably have negative impact of foreign investment on the economy due to the negative spillovers brought by the foreign companies into the host country.

...............................

2.2 Spillover of FDI in the High-Tech Manufacturing Industry of China and India

It has been discussed above that a large proportion of the manufacturing sector is actually covered by the High-Tech Manufacturing Industries. In addition, international technology spillovers, are the key to understand how an FDI and trade impact the host countries. Therefore, both of these will be briefly discussed in this section.

Knowledge emerging from one country or a nation go beyond the geographical boundaries and significantly contributes the technological development of other countries, particularly the developing countries (Fan 2002). The spillover effect is significantly important for the domestic firms to benefit from FDI. It is widely researched topic and several studies have been conducted on positive as well as insignificant or even negative spillover effect on the local industry (Liu and Wang 2003, Marin and Bell 2006). However, the research results may vary due to several factors such as; different empirical methods, varied levels of used data and also the different levels of absorptive capacity in the host countries. It is noteworthy that getting access to the technology spillover of FDI is the desired mean for manufacture industry, particularly, the high-tech industry in the developing countries (Caves and Caves 1996). This is due to the fact that multinational companies often prefer to transfer their technology to a wholly owned subsidiary rather than joint ventures or third parties.

The existing literature that focuses the FDI technology spillover clearly indicates the positive spillovers based on vigorous research focusing several countries across the globe (Javorcik and Spatareanu 2008, Suyanto and Salim 2011, Jude 2016). In the context of China, most of the research that is focusing China, also indicates the FDI positive technology spillovers in China (Wang, Liu et al. 2016). Even the government strongly encourages the research and innovation in this sector, especially the high-tech sector. For instance, government provides tax-free incentives to the firms if they produce new developments. In China, high-tech industries are often referred as " pillar", however, all receive the same support from the government (Liu and Zou 2008). In China, high tech industry is regarded as a leading industry not only in national economic development, but it is also a key carrier in absorbing and applying advanced technology.

.............................

CHAPTER 3: METHODOLOGY ............................ 17

3.2 Materials and Methods ............................... 18

3.3 Description of Variables............................. 19

CHAPTER 4: RESULTS AND DISCUSSION ................................ 30

4.1 Results and Discussion of China ................................ 31

4.1.1 Empirical Findings ...................................... 31

4.1.2 ARDL Bounds Test for Co-integration .......................... 33

CHAPTER 5: CONCLUSIONS AND IMPLICATIONS .................... 47

CHAPTER 4: RESULTS AND DISCUSSION

4.1 Results and Discussion of China

4.1.1 Empirical Findings

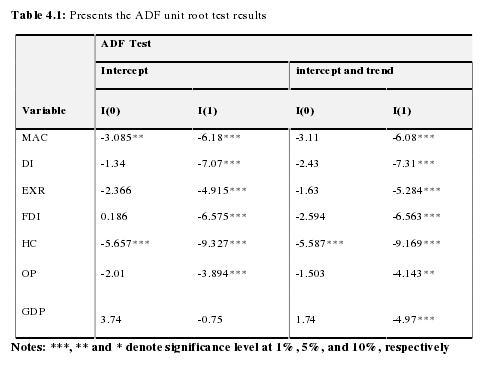

The first step is to determine the number of lags for the Dickey-Fuller unit root test. This is an essential and delicate procedure, as the results obtained from Dickey-Fuller test are sensitive to the selected lag numbers. The lags are obtained through the execution of vector auto regression (ARDL). The five-lag selection criteria consist of Final Prophecy Error (FPE), Akaike’s information criterion (AIC), Schwarz’s information criterion (SC), Hannan-Quinn Criterion (HQ), and LR test. For our purpose, we employed Akaike’s information criterion to determine the optimal lag. Once the optimal lag orders are determined, anan Augmented Dickey-Fuller unit root test (tables 1) is organized to determine the ranking of the variables. Application for testing the stationary variables of the variants is used to estimate the model of all Augmented Fuller (ADF) tests.

Table 4.1 is showing the ADF unit root test results. While, ***, **, * denotes the significance level at 1, 5 and 10% respectively. The results of this study show that five variables are non-static at level. On the other hand, in all its first differences, all the variables are stable. These results show that, with interference and tendency, all the variables are integrated into 1 (1). Such results of a stable test will not allow us to implement the Johannesburg view of co-integration. This condition of variables lead to apply auto-regressive dependent lags (ARDL) tests to check long-lasting relationships between variables. Time series data for all variables is used for the period from 1985 to 2017.

.................................

CHAPTER 5: CONCLUSIONS AND IMPLICATIONS

The current presents the detailed study on the impact of FDI on manufacturing sectors of China and India by employing ARDL model using the time series data. It covers the structural changes in the economy during an appropriate time period. After covering the detailed body of the relevant literature in Chapter 2, a modified growth model was constructed that includes several factors such as FDI, MAC (manufacturing growth ) GDP, Human Capital, and Gross Domestic Capital Formation (DI), among which MAC was dependent variable while rest were independent variables.

The study reveals that the FDI have very much positive impact on the manufacturing sectors of both the China and India (FDI was taken as long-run coefficient which is the mean contributor of manufacturing growth (MAC ).The central government of China had put tremendous efforts to increase the potential of positive spillovers on domestic economy. In addition to the main variables, the control variables including the human capital, GDP, trade openness (OP) and exchange rate had significantly affected the Chinese Economy. The results also signify the importance of FDI for the technological spillover and the enhancement of technical knowhow. Also, the negative impact of the domestic investment on the manufacturing sector indicates the corresponding increase in the FDI. The results are consistent with the Ali and Wang (2018) describing the fact the outbound investment crowed out the domestic investment, that ultimately influences the manufacturing growth negatively and insignificantly. Whereas, India also shows the positive impact of FDI on the manufacturing sector. In addition to the main variables; the trade openness, GDP and exchange rate had positive impact on manufacturing growth of India. However, Indian unskilled and unhealthy human capital had an overall negative impact that is needed to be addressed. It is noteworthy that improvement in human capital (skilled and healthy workers) leads to productivity enhancement that boosts output.

reference(omitted)