本文是一篇企业管理论文,本研究旨在揭示管理信息系统和管理决策对吉布提私人银行业绩的影响。本研究还试图确定管理信息系统在吉布提私人银行管理决策质量中的程度和作用。本研究采用定量研究方法,以调查问卷作为数据收集工具。

Chapter 1: Introduction

1.1. Background

In modern times, the administration has faced a state of challenge as a result of the scientific and technological revolution. Therefore, in all fields, the means and complexity of management tasks and the requirements of their traditional performance in adopting personal experience and even methods of trial and error are no longer able to achieve the Organization's objectives informed decisions in the field of optimal investment of human resources, material and financial available. The decision-making process has become the core of the management process and its primary means of achieving the objectives of the organization. As it is a common factor for all administrative functions (planning, organizing, directing and controlling all aspects of the organization's organizational structure) for the objectives of the organization, aspects of its activities, the size that reached, its capital, as well as the numerous operational processes that hence has become imperative to focus on managers. All Principles and methods of decision-making are practiced within the principles and procedures for the implementation of decisions (Ismail, 2004).

The technological development witnessed by organizations in this era, as well as the size of the institutions and their geographical expansion to multiple regions and their transition to the stage of multi-nationality. The globalization and the emergence of the concepts of globalization, and the complexity of the relations gradually, both members of one organization or between the organization and others, factors have made the task of decision-making in the modern enterprise more difficult, and increased the workload and responsibility borne (Saudi, 2006).

..........................

1.2Research structure

This study was divided into six chapters, the first of which dealt with the general introduction, the research questions, and the objective of the study. The second chapter deals with study domain. The third chapter deals with theoretical background of the study. The fourth chapter deals with information management systems and the important role played by advanced Information Technology in increasing the efficiency of information systems, analysis and study of the decision-making process and its pivotal role in the organization, by representing the different views on decision-making in the company, types of decisions and stages, The effectiveness of management decisions, the role of data and information in increasing their effectiveness. The fifth chapter is a field study aimed at defining the field of study in private banks in Djibouti, then addressing the information flows in it, and then leads to study the impact of the administrative information systems adopted by the company in supporting management decisions through a collection tool Data, the most important form answered by most of the bankers and managers. The sixth chapter is an analysis of information using through Social Packages for the social sciences (SPSS). The last chapter presented the researcher’s suggestions and recommendations based on the results of the study.

..........................

Chapter 2: Study domain

2.1. Introduction in Djibouti and in the Finance Sector in General

In 2014 Djibouti’s economy achieved a growth rate of nearly 6%, according to estimates from the African Development Bank. While unemployment remains a challenge, this growth figure, coupled with a young and expanding population, points to the strong potential of the country. Ports, logistics and associated services remain the dominant economic activity, accounting for more than 90% of GDP, though Djibouti also has some natural advantages. In terms of metals and minerals, the country is home gold, granite, limestone and marble deposits. Djibouti is also looking to leverage its significant geothermal resources to satisfy domestic energy demand. According to World Bank estimates, the country’s population reached 876,200 in 2014 – the majority of which, more than 500,000 people, live in the capital, Djibouti City. Djibouti is also a young country, with more than half of the population under the age of 25. The two official languages are French and Arabic; however, with the ethnic composition of the country consisting mostly of Somalis (50%) and Afars (45%), these groups’ languages are also widely spoken. Djibouti is a relatively young country in political terms. It achieved independence less than 40 years ago and has had just two presidents in that time. Djibouti’s comparative stability in an otherwise volatile region has allowed the country to develop relatively quickly.

..............................

2.2. The Bank Sector in Djibouti

Djibouti's banking sector, which features both Islamic and conventional banks, has grown significantly in recent years and saw the arrival of new banks bringing the number of institutions to 11, compared with only two in 2006. The sector remains highly profitable with low level of nonperforming loans (approximately 6 percent). Even so, the sector remains very concentrated, with two main banks accounting for 85% of assets. Under newly enacted directives, all public and private sector employees earning more than FDJ 40,000 are required to hold a current account in banking institutions; a move which has led to an important increase in bank deposits. Between 2008 and 2009 commercial bank deposits increased by 19.3 percent to reach FDJ 183.9 billion, while sight deposits rose by 34.8 percent and bank balance sheets improved by 20.7 percent. However, weak enforcement of creditor rights and the absence of comprehensiveinformation on borrowers keep lending risks high. Bank lending has increased in recent years but still remains fairly limited, with the ratio of bank credit to bank deposits rising from 29.5 percent in 2006 to 37 percent in 2008 and 41.6 percent in 2009.

..............................

Chapter 3: Theoretical overview .................. 11

3.1. Stakeholder theory......................... 11

3.2. Decision-making theory ................. 13

Chapter 4: Hypothesis ........................ 15

4.1. The concept of information systems ................... 15

4.1.1. The conceptual foundations of the quality of the information systems ........... 16

4.1.2. Objectives of the information system:..................... 17

Chapter 5: Research design ...................... 34

5.1. Study Population and Data Collection .................... 34

5.2. Research methodology design............ 34

Chapter 6: study result

6.1. General descriptive:

General descriptive statistic is a way to analyze the background of each respondent.

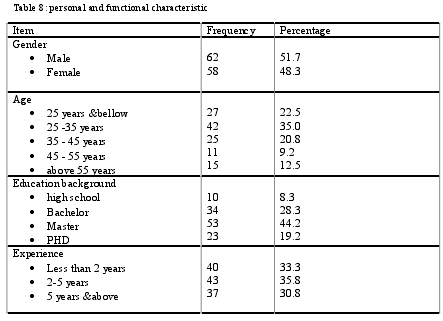

Based on the survey collected, of 120 questionnaires, 62 of respondents were males while 58 was female which almost exactly the same number of respondents. It illustrates that the respondents whose ages were between 25 and 35 got highest number of respondents while the respondents who ages less than 25 and 35 to 45 got only about half of them, and the rest of the respondents whose age more than 55 got only very few number. . Also, regarding to the respondents’ education, 53 responds was from master degree while the rest from high school, bachelor and PhD’s.

..........................

Chapter 7: Majoring findings and Conclusions

7.1. Major findings

After the presentation of the most important theoretical concepts related to information systems and their relation to decision-making in the organization, and after analyzing the hypotheses of the study through a field study of the private banks in Djibouti, it was possible to reach a number of results can be presented as follows:

1.The average age of decision makers in the company tends to middle age groups (25 to 45 years).

2.The decision makers in the company have an acceptable level of education, and sufficient to accept and understand the idea of introducing computer-based administrative information systems and relying on them to support the decision-making process.

3.The decision makers in the company have sufficient experience in the sector, and in the company in question, in particular, which makes it easier to take advantage of computer-based management information systems in decision-making, thus increasing its effectiveness.

4.The management information systems adopted by the company in question contribute greatly to increasing the accuracy of information in the company, and provide information, most of which is necessary to make decisions in a relatively fast time. It also gives a better form of information which facilitates the handling and utilization of them. It also contributes to making the information more quantifiable.

reference(omitted)

信息系统和决策对吉布提银行组织的绩效的企业管理影响研究

论文价格:免费

论文用途:其他

编辑:硕博论文网

点击次数:

如果您有论文相关需求,可以通过下面的方式联系我们

点击联系客服