本文是管理论文,管理论文涉及的领域非常广泛,包括工商管理、企业管理、行政管理、人力资源管理、信息管理、财务管理等诸多方面。管理论文实用性强,主要依托于管理理论的指导,运用全球化战略思维,借鉴国际上先进的管理经验,从企业战略的规划和制定到资产资本的运营,从人力资源的管理调配到企业的管理模式等等。(以上内容来自百度百科)今天硕博网为大家推荐一篇管理论文,供大家参考。

1 Introduction

1.1 Research background and significance

The society has kept making progress and the world economy is becomingincreasingly periodic. Under this case, small and medium sized companies haveturned to be the backbone of economic development for all countries if taking areview on the development history of global economy. Compared with other kinds ofcompanies, small and medium sized companies have their own characteristics in viewof their asset size and operation scales. Their survival and development plays a keyrole in promoting the economic development of all countries.At the same time, however, SEMs are weak in keeping operational stability andresisting risks, leading to problems like low credit and violation phenomenon.Therefore, they can’t get recognition from financial institutes like banks, resulting indifficulties of financing and sluggish development. To accelerate the development ofSEMs and help them relieve pressures on financing, governments of differentcountries have introduced financing guarantee and established related system toimprove the credibility of SEMs.However, it will not be easy to implement financing guarantee system. This is becausethat the high risks, imperfect governance structure and market system of SEMs haveled to a high venture nature of financing guarantee industry. To keep a sustainabledevelopment, financing guarantee corporations are required to manage various riskseffectively during the process of operating.By establishing an overall risk management system with the aid of scientific method,financing guarantee corporations can better control risks and achieve sustainabledevelopment.

.........

1.2 Research contents and approaches

This dissertation is composed of 4 parts. They are explained as follows:Part 1(chapter 1) is the introduction, explaining the background, purpose andsignificance of this dissertation. It also sets up a framework for the research.Part 2 (including chapter 2, 3 and 4) has analyzed theories related to risk management.Relevant literatures are explored and the risks as well as business model of financingguarantee corporations are explained. It has also introduced the status quo of thewhole industry in China with a case analysis of JC Finance Guarantee Corporation.Part 3 (including Chapter 5 and 6) is the core of the dissertation. A basic frameworkfor established enterprise risk management system has been formulated.Part 4 (Chapter 7) has made a summary and has pointed out the shortcomings of thedissertation, providing prospects for further study.Based on literatures both at home and from abroad, this dissertation has explainedtheories related to risk management of financing guarantee. It is then followed by acase analysis of JC Finance Guarantee Corporation whose risks and causes have beenexplored. Then the business model and major risks of financing guaranteecorporations are introduced. It has also been extended to the status quo and future ofthe whole industry. Finally, based on enterprise risk management theory, a basicframework is established deal with risks by incident recognition and risk transfer orsharing. in the meantime, the internal environment and activity and informationmanagement system should also be improved provide favorable conditions for riskmanagement.

..........

2 Literature Review

2.1 Connotation of Risk Management

Risk management is a method used to deal with risks and guarantee the safety underthe guidance of cost benefit principle. Risk management controls the risks from theirroots through incident recognition, evaluation and response. And finally, the results ofrisks will be properly handled.Enterprise risk management intends to create the atmosphere of risk management inthe company and to control risks occurring during operation with the aid of supportingsystem like information system. It is established under the framework of overall riskmanagement system. And its final goal is to help the company achieve businessobjectives.Overall risk management entails a series of factors. Different from traditional riskmanagement, its management philosophy is that risks should be evaluated fromholistic perspective. And its management objects are risks confronting the company.Overall risk management is targeted at achieving the maximization of value and profitfor the company of shareholders. The tools used in overall risk management involvesValue-at-Risk model and risk adjusted return on capital. With the aid of compoundmode and risk-management tools, the chief risk officer is responsible for collectingrisks and managing them.

............

2.2 Connotation and Elements of COSO Overall Risk Management

In September 2004, COSO Committee issued Integrated Framework for Overall RiskManagement. This document has given a clear definition of overall risk managementand provides guidance for the implementation of risk management.COSO believes that uncertain incidents will influence the business activities of acompany. And the function of overall risk management is to identify these incidentsand evaluate their influence on the operation of the company. Negative influence mustbe managed and controlled. Overall risk management must be conducted throughoutthe whole of process of company operation. All the employees are supposed to beinvolved to achieve business goals for the company.Overall risk management is used throughout the process from setting business goals totheir implementation. It is composed of dimensions, targets, tiers and elements. Under the three dimensions, the eight elements and four tiers all serve the four goals. Riskmanagement of each tier is conducted according to 8 factors. And each riskmanagement is accordingly targeted at specific goals, factors and tiers ( as shown inFigure 2-1).

.........

3 Introduction to Financing Guarantee Industry and Companies......12

3.1ABrief Introduction to Financing Guarantee Companies........12

3.2ABrief introduction to JC Financing Guarantee Company.....19

3.3 The Business Model of JC Financing Guarantee Company....19

3.4 Risks of JC Financing Guarantee Company..........23

4 The Status Quo of JC'S Risk Management and Analysis of Causes to Risks...........25

4.1 The Status Quo of JC Financing Guarantee Company’s Risk Management... 25

4.2Analysis of Causes to Risks of JC Company.........31

4.2.1 Systematic Risks..........31

4.2.2 Unsystematic Risk.......31

5 Suggestions on Optimizing the Strategic Risk Management of JC Company..........35

5.1 Establishment of Goals......35

5.2 The Construction of Management Process............36

5.3 The Construction of Supporting Facilities....36

5.4 Risk Recognition of Financing Guarantee Company..... 40

5.5 RiskAssessment of Financing Guarantee Companies....44

5.6 Risk Response of Financing Guarantee Companies.......50

5 Suggestions on Optimizing the Strategic Risk Management of JC Company

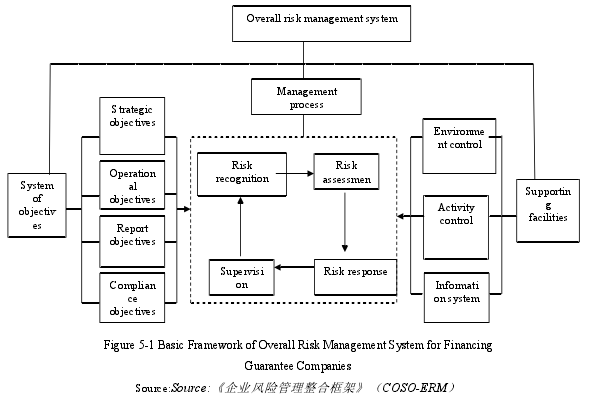

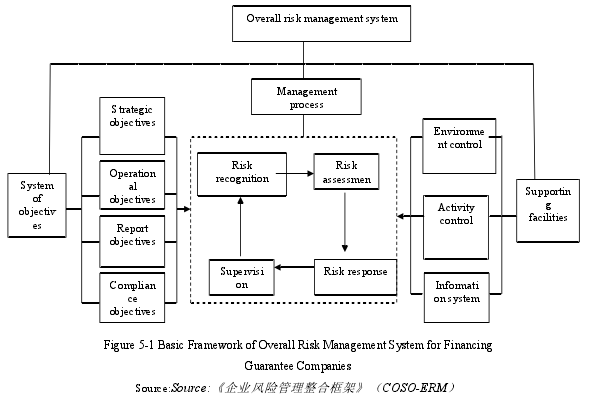

Based on the diversification of risk and causes analysis, this chapter intends toestablish a basic framework of overall risk management system for financingguarantee companies. This system is designed to recognize and resolve risks. Theframework is shown in figure 5-1:

5.1 establishment of goals

The establishment of strategic objectives should be combined with the mission andvision of the company. Based on financing guarantee, the strategic objective of JCCompany is providing services for SEMs,; seeking to multilateral benefits involvingshareholders, executives and employees; achieving sustainable development.The operational goals should be established upon the practical situation of the company bt resolving the goals into safety goals and profitable targets. The safetygoals are established for risk management. And realize this goal, compensation rate,loss rate and other commonly used measurements can be introduced. Profitable targetsare related to the profitability of the company. Measurements like income fromguarantee service and net profit can be introduced as goals. Development goals arethose which are related to the future development of the company. The goals can bemeasured by the number of branches, business volume and the number of employees.

.........

conclusion

Financing guarantee industry provides credit enhancement for the financing ofmiddle- and small-sized enterprises, which help solid support to solve their problemsin financing. However, financing guarantee industry is commonly believed to containhigh risk and low benefit. Therefore, it is a must to pay attention to risk management.Based on the JC case analysis of financing guarantee, the thesis adopts COSOEnterprise Risk Management Framework to build an enterprise risk managementframework for financing guarantee companies. The study has the followingconclusions.Despite the high risk in financing guarantee enterprise, risk is not entirelyuncontrollable. By establishing comprehensive risk control system, risk can bemanaged effectively. Financing guarantee companies that provide financing and creditenhancement services are facing a series of risks, whose uncertainty and complexitymay cause them to suffer from compensatory loss. By establishing a comprehensiverisk management system, generating risk control awareness at every level internallyand creating a benign risk control environment, risks can be control and manageddynamically, which can thus provide guarantee for the sustainable development of thecompany.Constructing comprehensive risk management framework in financing guaranteeenterprise includes the construction of objective, management process and supportingfacility. The construction of objective focuses on the construction of strategy,operation, report and compliant objectives; management process revolves aroundobjective elements and constructs a management closed cycle of identification ofevent, appraisal of risk, risk handling and supervision, which provides constantdynamic management on company risks; Construction of supporting facility refersconstructing benign internal environment, control activity and information system,which ensures the effective operation of the whole system.

..........

References (abbreviated)