1 Introduction

1.1 Background

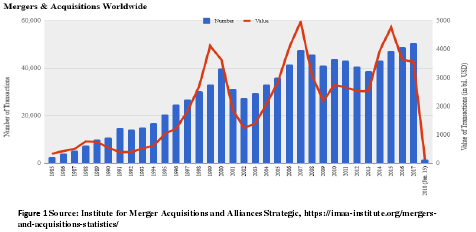

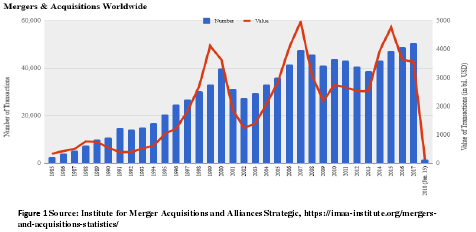

On a global level, an increasingly large number of companies, especially after the 2009 international economic recession have been engaging in M&A. In recent years it is observed that there has been a steady increase in the number and value of M&A‟s on a global level. The value had a significant increase from 2005 to 2017, US $2859 billion to US $3559 billion (graph 1), on the other hand, the number of transactions almost doubled from 36,201in 2005 transaction to 50,626 in 2017, and is on continuous growth, according to the Institute for Merger Acquisitions and Alliances Strategic.

PWC (2016) report presents the evidence that, in 2015, the scale of Global Technological M&As reached US $313 billion, while the total amount of M&As in Chinese high-tech industry reached US $122 billion. Therefore, technological M&A have become an important method to acquire, absorb, utilize, and explore advanced technology knowledge by companies.

On a global level, an increasingly large number of companies, especially after the 2009 international economic recession have been engaging in M&A. In recent years it is observed that there has been a steady increase in the number and value of M&A‟s on a global level. The value had a significant increase from 2005 to 2017, US $2859 billion to US $3559 billion (graph 1), on the other hand, the number of transactions almost doubled from 36,201in 2005 transaction to 50,626 in 2017, and is on continuous growth, according to the Institute for Merger Acquisitions and Alliances Strategic.

PWC (2016) report presents the evidence that, in 2015, the scale of Global Technological M&As reached US $313 billion, while the total amount of M&As in Chinese high-tech industry reached US $122 billion. Therefore, technological M&A have become an important method to acquire, absorb, utilize, and explore advanced technology knowledge by companies.

........................

1.2Innovative efficiency: "high and low"

Innovation has a significant impact on technology acquisition decisions (Entezarkheir and Moshiri, 2016; Bena and Li, 2014). However, there is no argument on what kind of innovation characteristics affect M & A decision, especially the impact of innovation efficiency. Innovation efficiency refers to the ability of an enterprise to obtain innovative output given R & D investment.

1.2Innovative efficiency: "high and low"

Innovation has a significant impact on technology acquisition decisions (Entezarkheir and Moshiri, 2016; Bena and Li, 2014). However, there is no argument on what kind of innovation characteristics affect M & A decision, especially the impact of innovation efficiency. Innovation efficiency refers to the ability of an enterprise to obtain innovative output given R & D investment.

Higgins and Rodriguez (2006) argue that the more the patentee the main company has, the more internal bargaining power it has compared with the target company and the lower the premium paid will be, therefore, it is more likely to initiate technology mergers and acquisitions. Based on the M & A events of US-listed companies from 1984 to 2006, Bena and Li (2014) found that M & A companies are more innovative and have more patents, while their R & D investment is relatively small, so these enterprises have higher efficiency in innovation. In contrast, the target company's internal investment in R&D is significantly higher, but its patent growth rate is very low, so because of this, these Innovative efficiency: "high and low “companies are less innovative; Entezarkheir and Moshiri (2016) based on the 1980-2003 M & A of US manufacturing listed companies, found that innovation capacity significantly increased the probability of participation in technology mergers and acquisitions.

..........................

..........................

2 Literature review

2.1 M&A literature in relation to innovation literature

Corporate acquisitions are strategic actions that loom large in the minds of many managers. Despite decades of systematic research of study, little conclusive knowledge is existent on the main question: why do the acquisitions of some companies perform better than those of others? The researches that has been discussing this issue has focused mainly on deal-precise variables (i.e., how procurement takes place).

RBV suggests that competitive advantage lies in the resources and capabilities of the company (Barney, 1991; Conner, 1991; Peteraf, 1993; Teece and Pisano, and Shuen, 1997). This view is based on an assumption that firm resources are both heterogeneous across firm and imperfectly mobile (Barney, 1991; Capron and Hulland, 1999; Hunt and Morgan, 1995). Firm resources (e.g., Rand.D projects, products) are stocks of knowledge and other tangible and intangible factors that a firm owns and controls, accumulated in a firm-specific and path-dependent manner (Swaminathan, Murshed, and Hulland, 2008; Yu, Umashankar and Rao, 2016). Through acquisitions enterprise-specific assets within an organization merged with assets in another organization to reallocate resources to more productive uses (Capron, Dussauge, and Mitchell, 1998; Capron, Mitchell, and Swaminathan, 1998), improve the productivity of combined assets (Haspeslagh and Jemison, 1991; Anand and Singh, 1997) and enlarge the acquirer is the knowledge base, technological knowledge and technical capacity (Ahuja and Katia, 2001; Huang, Wang Yu, 2017).

...........................

Corporate acquisitions are strategic actions that loom large in the minds of many managers. Despite decades of systematic research of study, little conclusive knowledge is existent on the main question: why do the acquisitions of some companies perform better than those of others? The researches that has been discussing this issue has focused mainly on deal-precise variables (i.e., how procurement takes place).

RBV suggests that competitive advantage lies in the resources and capabilities of the company (Barney, 1991; Conner, 1991; Peteraf, 1993; Teece and Pisano, and Shuen, 1997). This view is based on an assumption that firm resources are both heterogeneous across firm and imperfectly mobile (Barney, 1991; Capron and Hulland, 1999; Hunt and Morgan, 1995). Firm resources (e.g., Rand.D projects, products) are stocks of knowledge and other tangible and intangible factors that a firm owns and controls, accumulated in a firm-specific and path-dependent manner (Swaminathan, Murshed, and Hulland, 2008; Yu, Umashankar and Rao, 2016). Through acquisitions enterprise-specific assets within an organization merged with assets in another organization to reallocate resources to more productive uses (Capron, Dussauge, and Mitchell, 1998; Capron, Mitchell, and Swaminathan, 1998), improve the productivity of combined assets (Haspeslagh and Jemison, 1991; Anand and Singh, 1997) and enlarge the acquirer is the knowledge base, technological knowledge and technical capacity (Ahuja and Katia, 2001; Huang, Wang Yu, 2017).

...........................

2.2 Factors that affect the technology M & A decision

Acquiring the innovative resources of the target company is the main motivation for technology acquisitions. So, what factors affect the company's technology M&A decisions? Scholars have done extensive research on the preconditions of technology mergers and acquisitions. To shortly sum up, mainly including the size of the organization, organizational structure, and innovative features.

Acquiring the innovative resources of the target company is the main motivation for technology acquisitions. So, what factors affect the company's technology M&A decisions? Scholars have done extensive research on the preconditions of technology mergers and acquisitions. To shortly sum up, mainly including the size of the organization, organizational structure, and innovative features.

The most common scenario in M & A activity is the large companies' acquisitions of newly created SME-intensive firms to absorb and internalize the companies technological innovation potential (Sears and Hoetker, 2014). These start-ups may be the source of breakthrough innovation and new technical knowledge (Anderson and Xiao, 2016). According to the report of the American Science Foundation, the proportion of R & D in the whole industry invested by enterprises with less than 1000 employees rose from 4.4% in 1980 to 25% in 2003 (Benson and Ziedonis, 2009). Therefore, technology-intensive SMEs more easily become the target of technology mergers and acquisitions.

...........................

...........................

3 Hypothesis Proposal ....................... 22

3.1 Before vs. after M&A impact on company innovation .................... 22

3.1 Before vs. after M&A impact on company innovation .................... 22

3.2 Time frame of the effects of M&A on the company innovation ................ 22

4 Methodology .................... 25

4.1 Research planning .............. 25

4.1 Research planning .............. 25

4.2 Research method .................. 27

5 Results ...................... 44

5.1 Wilcoxon signed ranks test ....................... 44

5.1 Wilcoxon signed ranks test ....................... 44

5.1.1 Post-merger Wilcoxon test .................... 44

5.1.2 Pre-merger Wilcoxon test ....................... 48

6 Discussion

The overall impression of the reseals is very good, and the author is satisfied with the outcome. All the hypothesis ware tested thru an

econometric model. The author used two Poisson regression models approach and combined with Wilcoxon signed rank test, in conducting the

research. The combination of the two methods was a good one because it helps prove each other‟s results. On the other hand, the Wilcoxon

signed rank test was used in testing the hypothesis, if the innovation output of the firm after the merger was improved by the effect of the merger, in comparison with the innovation output of the company before the merge. The Poisson regression model was used to test the independent variables that have the greatest influence on the dependent variable, the author here focused on two aspects; one was if the acquisition percentage of the buying company had an effect on the innovation output. The second was if SOE companies have a better performance in terms of innovation output after the merger. The author believes that the research method used provides a valuable outcome that adds to the existing knowledge base in the field of merger acquisition and the effect it has on innovation output.

............................

The overall impression of the reseals is very good, and the author is satisfied with the outcome. All the hypothesis ware tested thru an

econometric model. The author used two Poisson regression models approach and combined with Wilcoxon signed rank test, in conducting the

research. The combination of the two methods was a good one because it helps prove each other‟s results. On the other hand, the Wilcoxon

signed rank test was used in testing the hypothesis, if the innovation output of the firm after the merger was improved by the effect of the merger, in comparison with the innovation output of the company before the merge. The Poisson regression model was used to test the independent variables that have the greatest influence on the dependent variable, the author here focused on two aspects; one was if the acquisition percentage of the buying company had an effect on the innovation output. The second was if SOE companies have a better performance in terms of innovation output after the merger. The author believes that the research method used provides a valuable outcome that adds to the existing knowledge base in the field of merger acquisition and the effect it has on innovation output.

............................

7 Conclusion

7.1 Expected research implications

This research makes several theory contributions. First, this research explores a time period of the impact of external knowledge sources after technology acquisition. Technology acquisition served as a kind of method of knowledge acquisition, the learning and absorptive activities need a longer time. Therefore, this paper provides a window period for the examination of what and how the external sources impacts knowledge acquisition as regards to technological acquisition, based on the theories of dynamic capabilities, learning process and knowledge upgrading time-lagged.

Second, using a Wilcoxon signed rank test, we confirmed the subsequent innovation of acquiring firms and we found the second/ third years are the watershed time point for innovation performance change. The empirical focus on continuous behavior of technological acquisitions over the sample span enables us to distinguish the learning outcomes in different period, thus identifying the heterogeneous impact of distinctive time span on innovation. The finding suggests that the innovation effect of technological acquisition is not significant only until the second/ third year after the deal.

reference(omitted)

This research makes several theory contributions. First, this research explores a time period of the impact of external knowledge sources after technology acquisition. Technology acquisition served as a kind of method of knowledge acquisition, the learning and absorptive activities need a longer time. Therefore, this paper provides a window period for the examination of what and how the external sources impacts knowledge acquisition as regards to technological acquisition, based on the theories of dynamic capabilities, learning process and knowledge upgrading time-lagged.

Second, using a Wilcoxon signed rank test, we confirmed the subsequent innovation of acquiring firms and we found the second/ third years are the watershed time point for innovation performance change. The empirical focus on continuous behavior of technological acquisitions over the sample span enables us to distinguish the learning outcomes in different period, thus identifying the heterogeneous impact of distinctive time span on innovation. The finding suggests that the innovation effect of technological acquisition is not significant only until the second/ third year after the deal.

reference(omitted)