本文是一篇英语论文,笔者通过分析C公司引入智能客服、移动应用、大数据分析等数字化措施的实际效果,证实其服务质量得到显著提高。C公司数字化转型的成功实践为保险行业数字化变革和客户服务质量提升提供了理论参考和实践指导。

Chapter 1 Introduction

1.1 Research Background and Significance

1.1.1 Research Background

In recent years, with the rapid development and wide application of emerging technologies such as mobile internet, big data, cloud computing and artificial intelligence, the pace of digital transformation in the insurance industry has been accelerating. More and more insurance companies have begun to actively explore and apply digital technologies to improve operational efficiency, reduce costs, optimize customer experience and enhance market competitiveness. Digital transformation has become an inevitable trend for the future development of the insurance industry and the key to the survival and development of insurance companies.

In the context of digital transformation, customer service quality has become a key factor in the competition of insurance companies. Customers' expectations of insurance services are rising, and they are no longer satisfied with simple product purchase and claims services, but pay more attention to the convenience, personalization, transparency and security of services. Insurance companies must actively utilize digital technology to enhance the quality of customer service in order to meet the growing needs of customers and win their trust and loyalty.

英语论文怎么写

.......................

1.2 Research Questions and Objectives

1.2.1 Research Questions

By investigating and analyzing the current situation of digital services of Insurance Company C, we understand the current situation, characteristics and development trend of its digital services, and lay the foundation for the subsequent research.

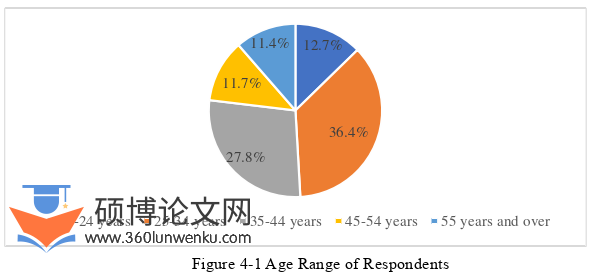

The digital service quality assessment system based on SERVQUAL model is constructed, and data are collected using questionnaires, semi-structured interviews and other methods to assess the digital service quality of Insurance Company C.

For the problems of digital service quality in Insurance Company C, corresponding improvement strategies are proposed, including optimizing the digital service process, strengthening the training of digital service personnel, improving the functions of the digital service platform, and establishing a digital service quality assessment and feedback mechanism.

1.2.2 Research Objectives

The purpose of this study is to deeply explore the current situation, problems and strategies of the development of customer service quality improvement of C insurance companies in the context of digital transformation, and to construct an assessment system based on the SERVQUAL model to assess the digital service quality of C insurance companies, so as to provide references and suggestions for C insurance companies to improve their customer service quality.

..........................

Chapter 2 Literature Review

2.1 Definition of Key Concepts

Service quality is a multidimensional concept, and its definition and measurement methods have been the focus of attention in both academic and practical fields. Due to the intangibility, heterogeneity, inseparability and perishability of services, the evaluation of service quality is more complex than product quality. Early research focused on product quality management in manufacturing industry, while the research on service quality started later.

Gronroos (1984) defined service quality as a combination of technical quality and functional quality. Technical quality refers to the outcome of the service, i.e., what the customer receives; functional quality refers to the quality of the service process, i.e., how the customer receives the service. Parasuraman et al. (1985) proposed the SERVQUAL model, which defines service quality as the gap between the service perceived by the customer and the service expected by the customer. The model contains five dimensions: reliability, responsiveness, assurance, empathy and tangibility. Zeithaml et al. (1990), on the other hand, from the perspective of cognitive psychology, argued that service quality is the customer's subjective evaluation of the service's merits and demerits and is an attitude rather than an attribute.

......................

2.2 SERVQUAL Service Quality Evaluation Model and Application

In the insurance industry, SERVQUAL model can be used to measure the service quality of insurance companies, such as the speed of claim settlement, service attitude, policy management and so on. With the application of digital technology, the SERVQUAL model needs to be adjusted and improved accordingly to adapt to the new characteristics of digital services. For example, in digital services, the tangibility dimension may need to be redefined to focus more on aspects such as website design and APP interface.

SERVQUAL theory is based on Total Quality Management (TQM) theory in the service industry proposed a new service quality evaluation system, the core of the theory is the “service quality gap model that: service quality depends on the degree of difference between the level of service perceived by the user and the user's expectations (also known as the ‘expectation-perception’ model), the user's expectations is a prerequisite for quality service, the key to providing quality service is to exceed user expectations. SERVQUAL divides service quality into five dimensions: Tangibles, reliability, responsiveness, security, emotional commitment, each of which is subdivided into a number of issues, through questionnaires, so that the user's expectations of each issue, the actual feeling of the value of the value and the minimum acceptable value for scoring, and by which relevant specific factors are established to account for it. The service quality score is then derived from the questionnaire, customer scoring and comprehensive calculations.

.......................

Chapter 3 Case Description ......................... 18

3.1 Introduction of Company C ................................ 18

3.2 Current Situation of Company C’s Digital Insurance Service ....................... 19

Chapter 4 Analysis of Customer Service Quality Issues and Causes .................... 28

4.1 Questionnaire Design ................................... 28

4.2 Questionnaire Scale and Pre-Test Results ................. 32

Chapter 5 Scheme Validation and Effect Evaluation ........................... 47

5.1 Overview ....................... 47

5.2 Specific Implementation Projects ..................... 47

Chapter 5 Scheme Validation and Effect Evaluation

5.1 Overview Insurance

Company C is concerned about how to use digital technology to further improve the quality of customer service. Based on the preliminary customer research, the company has adopted several strategies:

(1) Transforming the claims process with digital technology and introducing OCR intelligent review technology to improve the time efficiency of claims settlement.

(2) Build an online service platform to improve service response time.

(3) The use of big data analysis, tailor-made personalized product services.

英语论文参考

..............................

Chapter 6 Conclusions, Implications and Limitations

6.1 General Conclusions

Based on the comprehensive analysis of the case study, this research draws the following conclusions:

Digital transformation offers a significant opportunity to enhance customer service quality in the insurance industry. C Insurance Company's successful implementation of digital initiatives, including OCR intelligent review, online service platforms, and big data analytics, has resulted in demonstrable improvements in claims processing efficiency, service response time, and customer satisfaction.

The SERVQUAL model provides a valuable framework for evaluating digital service quality in the insurance sector. This model's focus on tangible, reliability, responsiveness, assurance, and empathy dimensions allowed for a comprehensive assessment of C Insurance Company's digital service quality, revealing both strengths and weaknesses.

Companies like C Insurance Company should adopt a multi-pronged approach to digital transformation to improve customer service. This includes optimizing digital service processes, strengthening employee training, enhancing platform functionality, and establishing feedback mechanisms.

reference(omitted)