CHAPTER

1 INTRODUCTION

1.1 Background of the Study

Indonesia enhanced diplomatic relations with China in 1990, and the amount of trade between both countries had risen considerably after five years. There are some investment flows between China and Indonesia, but the volume is still relatively insignificant. At the current stage of development, the economy of both countries complements each other for trade between them (Atje & Gaduh, 1999). Since 1991, trade relations between China and ASEAN members have been formed, and the inter-state economy has been developing for decades. The ASEAN economy has been active in the trade agreements such as the ASEAN-China Free Trade Agreement (ACFTA) over the past two decades, the purpose establishing of ACFTA is to create free trade by reducing and removing barriers, tariff of trade, increasing market, investment services, and ASEAN and China have increased their economic cooperation (Dianniar, 2013). The free trade agreement aims to dispose of some of the products, reduce the tariffs, and eliminate trade barriers between trade partners, China and ASEAN were eliminate their problems through ACFTA (Yean & Yi, 2014).

Since the implementation of the ACFTA began, China became the third-largest trading partner for ASEAN. During 1995-2004, China's export to ASEAN member countries more than quadrupled from US $ 10 billion to US $ 44 billion China’s. Meanwhile, export has increased from ASEAN countries to China, from US$ 8,2 billion in 1995 to US$ 42,2 billion in 2004 (Liu, 2007). The total trade between China and ASEAN countries totaled US $ 178 and 18 billion in 2009 (Flick & Kemburi, 2012). In 2009, China was reducing the tariff of ASEAN goods expected to 2,4 percent from 5,8 percent (Wu, 2011). At the end of 2009, taxes decreased to 0-5 percent for 18 commodities. In 2004 was eliminated tariffs barries all of the commodities. The Early Harvest Program (EHP) was initiated in 2004, focusing primarily on increasing bilateral tariffs for 600 agriculture products, including live animals, which mainly focused on reducing the taxes for 600 agricultural products, including live animals, fish, dairy products, meat, other animal products, vegetables, and fruits (Yang & Martinez-Zarzoso, 2014). The principle of EHP is export-import between ACFTA members without a tariff where around 530 products include palm oil under the ASEAN-China EHP (Pambudi & Chandra, 2006).

..........................

1.2 Problem Statement

International trade is a trade between two parties from different countries. Parties that do this trade could be as individuals, companies and governments. International trade is one of the major factors for increasing GDP, RER, and FDI. International trade has an impact on economic, social, political interests. The Agreements on international trade have an impact on member countries. As in international trade on relations between China and Indonesia has negative and positive effects. This study to analyze the impact of ACFTA on palm oil trade between China and Indonesia using scientific methods by formulating a hypothesis. Information data is provided from several studies that define economic progress and trade patterns on bilateral progress between China and Indonesia.

The objectives of this study include the determinant effect of ACFTA on palm oil trade between China and Indonesia through variable perspectives included palm oil export, Gross Domestic Product (GDP), Real Exchange Rates (RER), Foreign Direct Investment (FDI), and Dummy Variables (ACFTA). Then, analyze the determinant effect of ACFTA for GDP, RER, FDI, and ACFTA on palm oil export between China and Indonesia. The purpose of this study is to use empirical work to analyze the effect of ACFTA on the palm oil trade between China and Indonesia using the scientific method by formulating a hypothesis. This study assesses the effect of trade in both countries through their financial variables. Furthermore, this research will show the implementation of ACFTA can improve the economic development of both countries. Data analysis based on this empirical analysis to appropriate values and data sources to be useful for future research on bilateral trade between China and Indonesia.

............................

CHAPTER 2 TRADE DEVELOPMENT BETWEEN CHINA AND INDONESIA

2.1ASEAN-China Free Trade Area (ACFTA)

The ACFTA is an agreement between the ASEAN countries and China to create a free trade area by removing tariff and non-tariff barriers (Ardiyanti, 2015). Free trade is the exchange of goods and services between countries without constraints, but even if there are obstacles, the amount of tax must be minimal (Flick & Kemburi, 2012). The ACFTA starts with the signing in Phnom Penh on 5 November 2002, and the implementation of ACFTA has begun in 2004 (Indriyani, 2016). The participants agreed to introduce an Early Harvest Program (EHP) that includes an agricultural and manufacturing package. By 1st January 2006, trade between ASEAN and China would be under 0 percent (Supriana, 2013).

Various studies have shown that Indonesia was not optimal for implementation ACFTA. The monthly export data from January 1990-December 2011 are used to compare export from Indonesia to China after implementation ACFTA. Time series data are available, the results of this paper indicate Indonesia is not optimally utilized the ACFTA, China getting more benefits then Indonesia [22]. The main objective is to check whether ACFTA has the potential to benefit both parties. Pre-ACFTA trade, which continues to grow between ASEAN and China, shows that ACFTA will generate economic benefits for ASEAN and China, but unfavorable factors include limited substitution between ACFTA and import within-ACFTA (Park, 2007). This study uses an econometric model with a simultaneous equation system, the estimated parameter used is Two Stages Least Squares (2SLS). Policies in the ACFTA era 2010-2015 were carried out using simulations. The results state that the implementation of the ACFTA trade liberalization agreement is detrimental to the Indonesian economy (Ferrianta, Hanani, Setiawan, & Muhaimin, 2012). ICRA Indonesia analyzes the benefits and challenges offered by ACFTA for the Indonesian economy, especially given the trade balance between Indonesia and China for the period 2005-2010. While the agreement has several positive implications, such as more significant product choices and lower product prices on the domestic market, more full access for Indonesian exporters to China’s market requires the management of some of the adverse effects, especially for the industrial sector (Ginting, 2011). This article uses the model of gravity, a board of data comprising 20 measurements and calculated by the system of fixed effects.

..................................

2.2The Palm Oil Trade between China and Indonesia

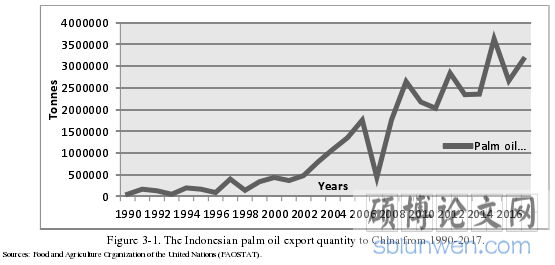

China is still a potential market for Indonesian agricultural products, especially palm oil export because China is in position four for palm oil consumption in the world 6,700 (1000 MT) and annual growth grate 3,36% (Food & Organization, 2019). China is the leading destination for Indonesian palm oil exports, the value of Indonesian palm oil export to China 3158827 tonnes in 2017 (Basiron, 2002). Indonesia's palm oil exports to China after The implementation of ACFTA amounted to 2174410 tonnes in 2010, 2032844 tonnes in 2011, and 2842112 tonnes in 2012. This shows that palm oil exports increasing after the implementation of the ACFTA, which is the tariff of ACFTA 0%. Palm oil exports have continued to increase to become 3158827 tonnes in 2017.

............................

CHAPTER 3 TRADE DEVELOPMENT BETWEEN CHINA AND INDONESIA ............ 16

3.1 ASEAN-CHINA FREE TRADE AREA (ACFTA) ............................ 16

3.2 THE PALM OIL TRADE BETWEEN CHINA AND INDONESIA .......................... 17

3.3 POLICY REGIME IN THE IMPLEMENTATION OF ACFTA ........................ 17

CHAPTER 4. METHODOLOGY ................................... 21

4.1 DEFENITION OF VARIABLES ................................. 22

4.2 DATA COLLECTION ............................... 22

4.3 TYPES AND SOURCES OF DATA ................................ 22

CHAPTER 5. RESULTS AND DISCUSSION ........................... 25

5.1 UNIT ROOT TEST ...................................... 25

5.2 LAG SELECTION CRITERIA ............................. 26

CHAPTER 5. RESULTS AND DISCUSSION

5.1 Unit Root Test

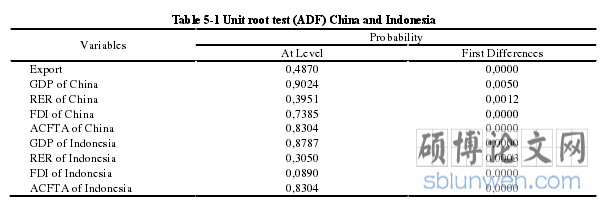

The unit root test used to test the assumption of a data time series stationary or not stationary. Stationary means there is constant in the data. The unit root test used to test the stationarity palm oil export Indonesia to China, Gross Domestic Products (GDP), Real Exchange Rate (RER), Foreign Direct Investment (FDI), and ACFTA (Dummy) for both countries. Im used the Dickey-Fuller test to check if the data is stationary or non-stationary[53]. The unit root test such as:

1. At Level

2. At the 1st Difference

3. At the 2nd Difference

Null Hypothesis (H0) is the variable not stationary or has a unit root, and Alternative Hypothesis (H1) is the variable stationery or does not have a unit root. If the unit root test shows the probability of less than 5 percent, it means the H0 is rejected and H1 is accepted or the variable stationery.

............................

CHAPTER 6. CONCLUSIONS, POLICY IMPLICATIONS AND SUGGESTIONS

6.1 Conclusions

The existence of the ASEAN-China Free Trade Agreement (ACFTA) for Indonesia has a significant influence on Indonesia's palm oil exports to China. These results indicate that there is a difference in the value of Indonesia's palm oil exports to China after the implementation of ACFTA. Empirical results using the extended gravity model show that GDP, Real Exchange Rates, FDI are the main factors affecting the economic progress of China and Indonesia. The VECM model shows the impact implementation of ACFTA. It is expected that the standard gravity variable has a static significance.

Under the theory of free trade, the presence of ACFTA to facilitate their export and import activities. The full implementation of ACFTA on January 1, 2010, has abolished tariffs on 6,683 posts in 17 sectors, but for palm oil export tariff reductions occurred in 2004 and the taxes were 0 percent in 2007, creating free trade and strengthening relations between China and Indonesia, especially palm oil trading. The Indonesian consumers to get benefit from buying cheap products from China and China exports of agriculture products from Indonesia such as palm oil and to grow to invest in Indonesia's infrastructure.

In the case of China, the results show the long-run relationship has positive effects and significant between palm oil export with GDP, RER, FDI, and ACFTA. The development of China's economy is classified as rapid. The demand has also increased China's energy. Total China’s energy consumption has the second-highest in the world. China is implementing the B5 program or 5 percent biodiesel mixture with diesel, the biodiesel in China has the potential to increase exports of Indonesian palm products because of the price of palm oil cheaper. China can get profits because of the lower cost of palm oil. Therefore, it will be increasing GDP. China had investments in Indonesia such as infrastructure, which is mostly the investments in Indonesia under China’s control. Other than that, results show that there is a short-run relationship between palm oil exports with GDP, FDI, and ACFTA.

reference(omitted)